Investing in solar panels offers homeowners and businesses in Illinois a unique opportunity to reduce energy bills, increase property value, and contribute to environmental sustainability. With federal tax credits, the Illinois Shines program, and utility savings, the financial benefits are substantial. Bluestem Financial Advisors’ own solar installation demonstrates a clear path to recouping costs and achieving long-term savings. However, impending changes to Illinois net metering regulations underscore the urgency of acting now to maximize these benefits.

Introduction

Imagine slashing your energy bills, boosting your property value, and doing your part for the planet — all at once. For savvy homeowners and forward-thinking businesses, investing in solar panels is the ultimate win-win. With a range of financial incentives available today, recouping your investment is quicker than you might think.

But here’s the crucial part: Illinois is about to shake up its net metering regulations, making this year the perfect time to dive into solar. If you’ve been on the fence or delaying your decision, now is the moment to act. We're here to break down the costs, incentives, and benefits, and show you how to calculate your return on investment. Ready to ride the solar wave? Let’s get started!

Federal Tax Credits

One of the most compelling financial incentives for solar installation is the Federal Energy Credits, worth 30% of the cost of system installation. This credit allows homeowners and businesses to deduct a significant portion of their solar installation costs from their federal taxes. Allowable costs include the panels, labor for site preparation and installation, and electric hookup. There is no maximum limit on the expenses that can be claimed, but your credit in one year cannot exceed your actual tax liability. The credit can be rolled over to subsequent years if it exceeds your tax liability for the year of installation.

Individuals would claim this via the Residential Clean Energy Credit while businesses would claim via the Business Tax Credits. While the credit limits are similar, the Business Tax Credits do have additional requirements to qualify.

Solar Renewable Energy Credits (SRECs)

In addition to federal tax credits, Illinois offers another powerful incentive through the Illinois Shines program, also known as the Adjustable Block Program (ABP). This program provides Solar Renewable Energy Credits (SRECs) to further offset the cost of solar installations. According to Illinois Shines, “RECs represent the environmental attributes of the electricity generated from solar panels, but not the electricity itself. Whoever owns the RECs has the right to say they used that solar power. By participating in Illinois Shines, the RECs from your solar project will be transferred to an Illinois electric utility. The sale of your RECs will not affect your solar project’s production or your ability to use the electricity generated by your solar project.”

You can think of RECs a little bit like a carbon tax system. Certain entities are required by law to produce green energy. Instead of installing those systems themselves, they can purchase the right to take credit for the green energy your system produces. While you still get to use the electricity itself, you sell the “credit” to them. SRECs are typically purchased in a batch, covering the expected production for the first 15 years of your system’s life.

Currently, the estimated SREC payment for Bluestem’s system is expected to recoup about 28% of the system cost in the first year.

Utility Savings

Finally, once the system is installed, we expect it will cover 100% of our annual electricity needs. Keep in mind, our office will continue to be connected to the grid. We will rely on it for electricity when the solar panels aren't producing enough energy (e.g. at night or during cloudy weather). We will continue to pay some electricity costs for administrative and connectivity fees. However, the delivery and consumption costs will net close to breakeven each year. For more, see discussion about Net Metering below.

We estimate that will result in annual electricity savings of $2,976 per year in savings. While savings are not known for sure, we believe this to be low as we are not factoring in future increases in the cost of electricity!

Summary

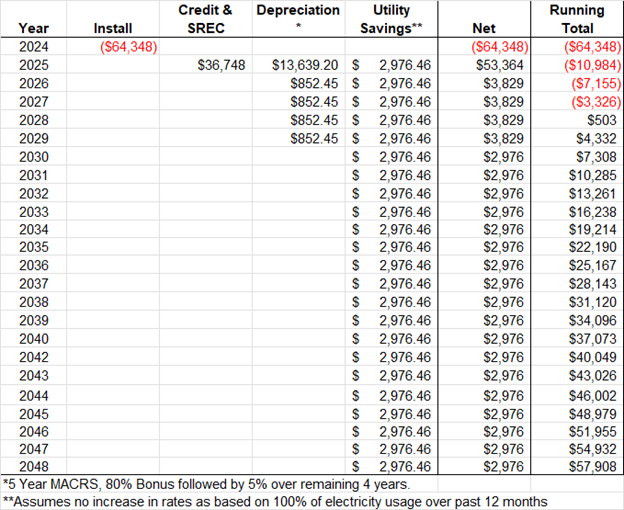

Here is a summary of the numbers from our system to illustrate:

Keep in mind, the numbers above illustrate the costs for installation on a personal residence. Businesses get an additional tax benefit through depreciation. Depreciation represents the tax savings by writing off the system cost as a business expense on tax returns. Solar systems are 5-year property and qualify for a bonus depreciation of 80% in year one, followed by a full write-off of expenses over the next four years. With this additional write-off, the payback period drops to less than five years!

Changes to Net Metering

The current design of our solar energy system relies heavily on net metering to calculate potential savings. Net metering allows system owners to reconcile the electricity generated by their solar panels with the electricity supplied by the utility company. This mechanism facilitates a balanced exchange where surplus energy generated on sunny days offsets deficits during periods of higher demand.

During the summer, when days are longer and sunnier, excess energy produced by our system is sent back to the grid, benefiting other customers. Our utility bill is then credited for this excess production. In the winter, when days are shorter and cloudier, or in the evenings when no power is produced, we draw electricity from the grid, using those credits to offset the power drawn.

However, it is crucial to note that net metering regulations in Illinois are set to change on January 1, 2025. Traditional net metering will cease for both residential and commercial properties across the state. This means that the financial benefits of our system could be significantly reduced, as excess energy produced within a billing cycle will no longer carry forward to offset future usage.

As upcoming regulatory changes will diminish these advantages, you may wish to pursue a system this year if you were thinking about pursing in the near future!

Conclusion

Transitioning to solar energy is not only a smart financial move but also a crucial step toward a sustainable future. With the current financial incentives and looming changes in net metering regulations, there has never been a more opportune time to invest in solar panels. At Bluestem Financial Advisors, we help our clients navigate the complexities of financial and tax considerations to make informed decisions. Act now to take advantage of existing incentives and secure your energy savings before regulatory changes take effect.