I recently finished my second half marathon, finishing the race just under my target time of two hours. While pleased with reaching a personal goal, there is nothing really compelling about my story. No overnight success, no major rise to overcome great obstacles. There was a time when running for fun would sound crazy, let alone running for hours on end. I started running 14 years ago to get into shape. I cannot say I really even enjoyed it at the beginning. My first runs were on a basement treadmill, 1 mile at a time. Soon a single mile was easy, so I pushed it to two and then three. For a challenge I decided to run a 5k, which lead to another and then another. Each time I aimed to cut my time by pushing my regular runs just a little faster and a little further. Each time I hit a goal, I moved the target just a little bit further. A little longer distance, a little shorter time.

My evolution has been slow and incremental. My progress from year to year is minimal, barely even noticeable. Review these changes over years, and the results are slightly more impressive. Change happened from minor adjustments made over time and the result of those adjustments compounded over time.

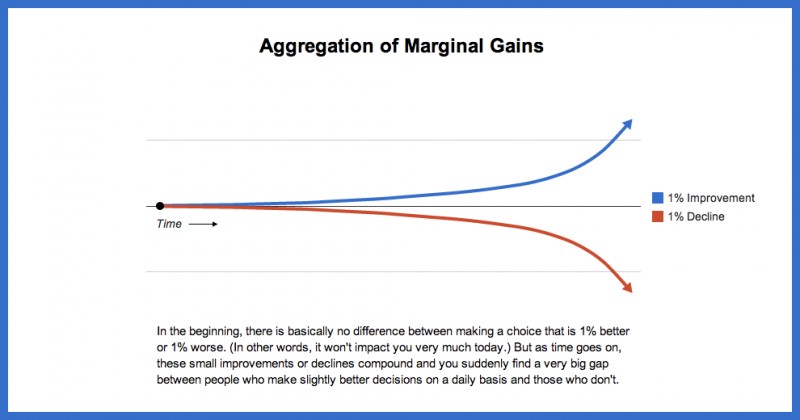

In a post appearing on The Daily Good, author James Clear outlines this same strategy. He describes how marginal changes led Great Britain’s cycling team to win the Tour de France in 2012 and 2013. Then, he shows the following illustration of how small changes, stacked onto one another lead to substantial changes over time.

This is a principle that we use daily with our Financial Planning clients. Big changes may happen at the beginning of our relationship, but planning is a long term process. An incremental series of good decisions and judgment based on an end goal will lead to long term success. As we work together year after year, we provide the long term perspective that keeps decision making on track and also reduces errors in behavior.

How can you apply this to your own financial life? Comment below if you want to share your own story.