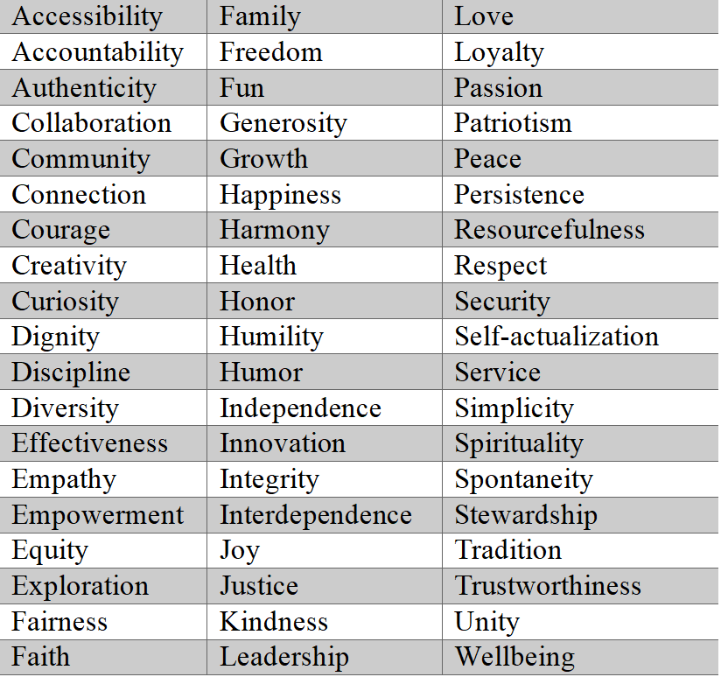

Try to narrow it to three from this list, five tops. Write them down. Are they reflected in your charitable contributions? Review that stack of receipts from charitable organizations, the one you compiled for your tax return. Is there an opportunity for you to establish a philanthropic plan that more intentionally aligns with your core values?

Identifying your philanthropic focus can make giving less reactionary and more meaningful. It's crucial to uncover your motivations for charitable giving to make sure that your donations have a more significant impact. I had the pleasure of getting to know a woman who did just that. She turned 100 recently, and we sat down to discuss her reflections on a lifetime of philanthropy. She told me that since she was a young adult, she has always been open to giving to community needs. As she became more experienced as a donor and volunteer, though, she realized how much her childhood experiences and her access to a good education, particularly a college degree, had influenced her life as an adult. With that in mind, she began to focus her dollars and her time in the areas of women and education, particularly in her local community. Her primary areas of support include programs that help women advance their education and employment opportunities.

Through her volunteer efforts, she also saw that many children did not have opportunities to interact in productive ways outside of the classroom, and that the only way many of them knew students of other schools was as rivals on the playing field or court. She decided that in addition to programs that help women achieve their personal goals, she would prioritize developmental and social programs that bring together children and teens from different backgrounds, believing that when combined with a good foundational education, these would help them grow into healthy, engaged citizens.

These areas of emphasis would, in this philanthropist’s thinking, improve lives and contribute to the betterment of society as a whole.

Another couple with whom I’ve worked had a particular interest in leadership development, as they had each risen to positions of prominence during their careers. This, too, is a broad category, so they spent time discussing where and how they wanted to have an impact. They landed on supporting student leadership programs at their alma maters, funding leadership development retreats and programs to bring back successful alumni for multi-day residencies. In addition, they funded an academic research project to determine the impact of one university’s student leadership programs on its alumni success, thereby informing the efficacy of their contributions and others’.

These are simply two examples of donors being intentional about their philanthropic focus. There are many others, whether they be healthcare, medical research, animal welfare, the arts, environmental sustainability, mental health – the list is long and the need for investment is great. Like other worthy endeavors, doing philanthropy well takes some work. The rewards, however, can be beyond measure.

This post was guest written by Shari Fox of Fox Philanthropic Advisors. If you would like to delve deeper into your personal or family philanthropic mission and practice, contact me at sharifox@foxphilanthropic.com for an exploratory conversation. The first one is on me.

The team at Bluestem believe that charitable giving can play a crucial role in helping our clients achieve a more fulfilled life. If you're interested in incorporating charitable giving into your tax and financial plan, we would love to help. Here is how to connect and learn more.

Fox Philanthropic Advisors LLC Disclaimer: This information is not intended as legal, tax, or financial planning advice. Readers should consult with their own professional advisors before making any charitable gift.