The forename Irma is of Germanic origins and means “universe.” For many retirees, Medicare IRMAA is of universally confusing origin. In this article we’ll cut through some of the bewilderment, and hopefully leave you with a sounder understanding of IRMAA’s purpose, calculation, and planning opportunities.

Medicare is a vital healthcare program for millions of Americans, providing comprehensive medical coverage for those who are 65 and older or have certain disabilities. However, Medicare costs can be significant, and some beneficiaries may struggle to afford their premiums. For those who are struggling, the government provides a variety of subsidies, which are funded in-part through a redistributive surcharge to high-income taxpayers known as Medicare Income-Related Monthly Adjustment Amount (IRMAA).

What is IRMAA? IRMAA is an increase to the monthly base Medicare Part B (medical insurance) and Part D (prescription drug coverage) premiums, which are generally paid via check or deducted directly from Social Security benefits. IRMAA is recalculated annually based on your most recently-filedrecently filed tax return’s modified adjusted gross income (MAGI), or in slightly more plain-terms, the total of your taxable income, tax-exempt interest income, and half of your Social Security benefits.

This calculation can be tricky to understand at first, though. Take the following example: In late 2022, to determine if and how much IRMAA applies for 2023 premiums, Social Security looks at your MAGI for on your most recently filed tax return—2021. Given that MAGI has the potential to swing widely from year to year, the delayed impacts of IRMAA can come as a bit of a surprise due to the backward-looking nature of the IRMAA calculation.

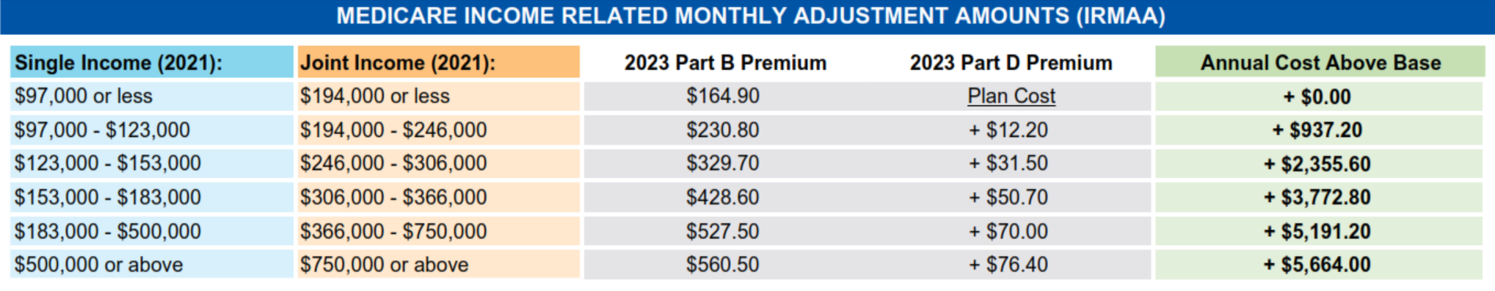

How much is the potential impact? The below chart illustrates the tiered MAGI system (based on your tax fillingfiling status) used to determine IRMAA. The Centers for Medicare and Medicaid Services (CMS) sets the income thresholds annually, and in 2023, the thresholds are as follows:

Given that the above costs are per person, you can see how much any sort of windfall or large change in income may impact your future IRMAA calculation. For example, the IRMAA for a married filing joint couple who had MAGI of $194,001 in 2021 would be an additional $1,874.40 ($937.20 per person) in premiums for 2023. Yes, you read that right; going even $1 over the threshold can add that much cost. .Rarely is the benefit of proactive income tax planning so evident as it is here—the cost savings of avoiding an inadvertent tumble over the cliff-like thresholds can be substantial.

What if I disagree with my IRMAA calculation? If you believe that your IRMAA is incorrect or that your the MAGI that which Social Security used to calculate IRMAA is from a year in which you have since experienced a “qualifying life event”, or QLE, you may be able to appeal your IRMAA with Social Security. The details of which such an appeal are typically laid out in the letter you get from Social Security explaining your IRMAA. As of the date of this writing, here is the current form used to appeal IRMAA, which includes a full list of “qualifying life events”. The most common QLE is retirement, and for married couples, it can be retirement for either spouse.

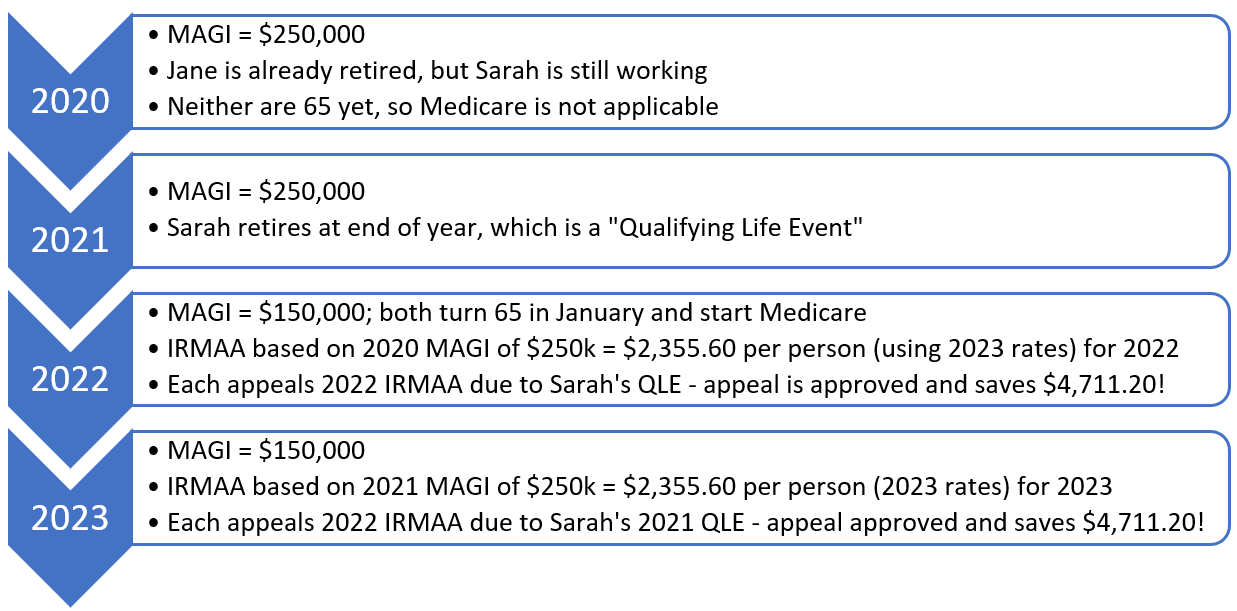

Given that backward looking nature of the IRMAA calculation, a QLE can often result in it being possible for multiple years of IRMAA being appealed. Use the following example: Sarah and her wife, Jane, file a Married Filing Joint return. Sarah retired in 2021 and she and Jane both turned 65 in 2022.

While the above example is not typical, it shows that understanding QLE’s while someone is on Medicare has the potential to result in significant savings, and it all starts with a better awareness of how IRMAA works. It’s not uncommon for someone older than 65 to experience a change in income that can impact IRMAA, so it’s important to remember that a change in IRMAA due to a spike in MAGI can only be appealed due to miscalculation of MAGI or a QLE.

On the surface, and even beneath it, the IRMAA system can be complicated... So, if you are nearing retirement or in retirement and wonder why your Medicare premiums are so high, it just might be worthwhile to check and make sure your IRMAA is being calculated correctly!

*Written in collaboration with chatGPT.