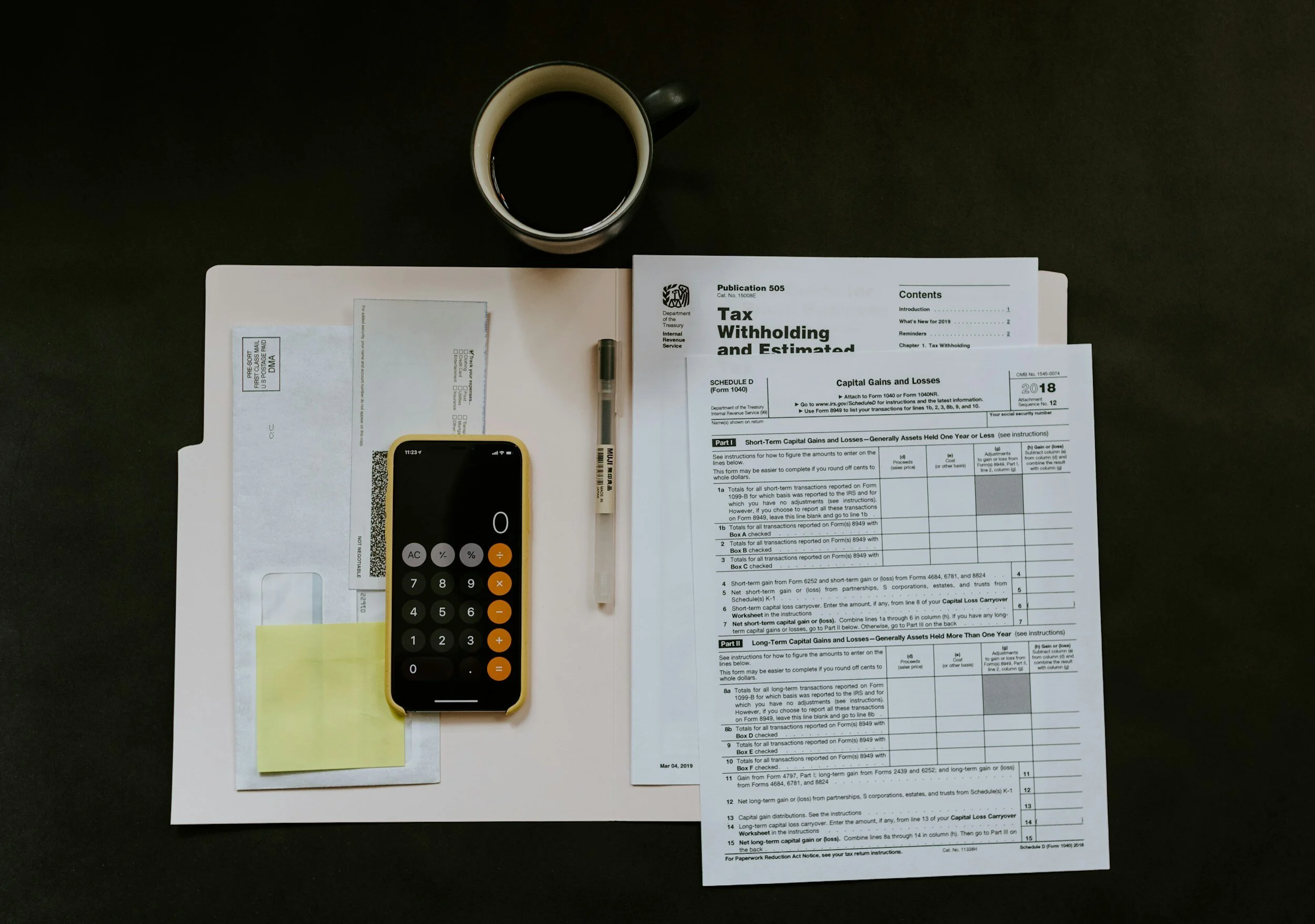

Looking to make room in your home office? Want to get rid of those old filing cabinets? Bluestem provides document shredding services for our clients. Click “Read More” below to learn more about this service and tips on how long to keep your old documents.

Tip of the Month: What Are Estimated Tax Payments?

Tip of the Month: Preparing for Tax Season

Looking Ahead: Planning For the Sunset of Tax Law in 2025

The Tax Cuts and Jobs Act (TCJA) significantly altered the tax landscape when it was enacted in 2017, but it included a “sunset” provision that goes into effect December 31, 2025. With divided control of Congress and an election ahead, planning for what might happen is very uncertain. Let’s the possible scenarios that could unfold, and how to plan for uncertainty.

Tax Tales: From Quirks to Quandaries

Finding Appropriate Tax and Accounting Help

Many industries in the last few years have had their services or products impacted by supply-chain issues or labor shortage issues. The world of public accounting, tax preparation, and CPA services have been no different. Don’t wait until the last minute to come up with a plan to find help with tax preparation!

How to Use Phone Scanning Apps - Digitize Your Paper Files!

Taxation of a Professor’s Other Income – Honoraria, Consulting, Editing, Royalties

SECURE ACT 2.0 – The Hits Keep on Rollin'

SURS Self-Managed Transitions to SURS Retirement Savings Plan

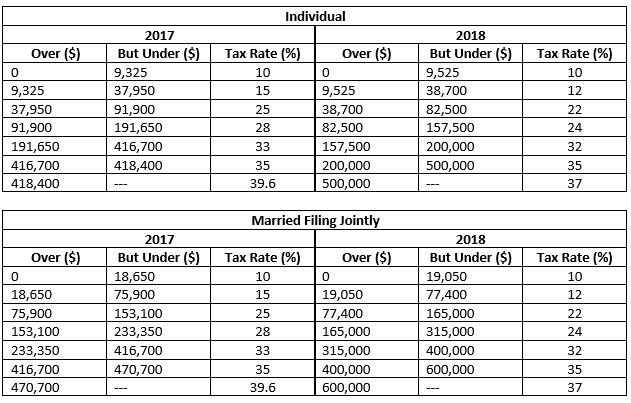

Tax Cuts and Jobs Act of 2017

As you may have seen, the House and Senate have reconciled a final version of the Tax Cuts and Jobs Act of 2017 which President Trump signed into law this morning. While the bill has been signed it is important to note that additional time will be needed for full interpretation and adjustments as corrections and revisions are expected.

While a significant portion of tax changes relates to business organizations, many changes will affect individual taxpayers, as well. With such a major restructuring, it will likely take months for all of the changes to be ironed out.

Tax Brackets: The revised tax plan retains a 7 bracket tax system as proposed by the Senate. Most of the brackets enjoy a decreased rate, although the ranges of taxable income that define each bracket have been significantly adjusted. Below are the new tax rates compared to 2017. The table can be used to estimate how your tax rate may change in 2018.

Outcomes: It is nearly impossible to generalize who will see increases or decreases by this change alone. High-income couples will see some relief from the so called “marriage penalty”, up to $600,000 of taxable income. Otherwise, you will need to reference the following changes to fully gauge impact on your taxable income (impacting how these rate changes affect you). Many people will see lower overall rates, but loss of deductions may increase others overall tax liability.

Standard Deduction and Personal Exemptions: The standard deduction for all taxpayers has nearly doubled from $6,350 to $12,000 for individuals and from $12,700 to $24,000 for married couples. However, simultaneously is an elimination of personal exemptions of $4,050 per family member.

Outcome: An increased standard deduction will limit the benefit for many taxpayers to itemize deductions. Individuals and married couples with no kids and minimal itemized deductions may see a slight decrease in tax, while larger families may see higher tax due to the loss of personal exemptions. Keep in mind, changes to the Alternative Minimum Tax (AMT) may impact these changes for your situation.

Child Tax Credit: The Child Tax Credit is being expanded with an increase from $1,000 to $2,000 per qualifying child under 17. Also, the income phaseout levels are increased from $75,000 to $200,000 for individuals and $110,000 to $400,000 for married filing jointly. Additionally, a new credit of $500 has been added for qualified dependents that are not qualifying children (children 17 and older or non-child dependents such as parent).

Outcome: Intended to make up for the lost benefit of personal exemptions, individual results may vary based on family size, age of dependents, etc. Higher income taxpayers may benefit the most as they may have previously seen no benefit from personal exemptions due to AMT while now being eligible for the expanded Child Tax Credit.

Itemized Deductions

Mortgage Interest Deduction: For new mortgage contracts following December 15, 2017, the deductibility of interest on a primary residence will be limited to the first $750,000 of debt principal, as opposed to the current limit of $1,000,000. Interest deductibility on Home Equity Lines of Credit (HELOC) will be eliminated for existing and new loans when funds are not used to buy, build, or significantly improve the primary residence.

Outcome: Mortgage and HELOC interest remains a useful tax strategy for many taxpayers that will still be itemizing. We will simply need to be extra diligent about keeping record of how HELOC funds are used.

Charitable Contributions: While relatively unchanged, the limit for deducting cash donations to charities is being increased from 50% to 60% of Adjusted Gross Income.

Outcome: With the increased standard deduction, more individuals may see a benefit in “bunching” their charitable gifts on an every-other-year strategy.

State and Local Tax Deduction: Originally, both the Senate and the House looked to either eliminate or severely reduce these deductions. The final version of the bill allows both deductions but at a combined cap of $10,000. The cap is the same for both individual and married filing jointly returns. Furthermore, any pre-paid 2018 State income tax will not be allowed on 2017 tax returns.

Outcome: The cap on these deductions may limit the benefitting of itemizing deductions for some taxpayers, especially in the greater context of all the changes going into effect. Some people may benefit from pre-paying certain taxes before 12/31/2017. If you make estimated tax payments, you might benefit from pre-paying your 4th Quarter State estimated tax payment before the end of 2017. For those of you who live in a county that accepts prepayments for real estate taxes, you may also benefit from pre-paying your real estate taxes. Please note, many high-income taxpayers subject to AMT may not benefit the prepaying strategies. However, those same taxpayers will not also see a tax increase due to changes as their deductibility was already limited.

Medical Expense Deduction: Surprisingly, the medical expenses deduction will be temporarily expanded. For tax year 2018 and retroactively for 2017, the AGI threshold for this deduction will be reduced from 10% to 7.5%. An additional adjustment allows taxpayers affected by AMT to still enjoy the 7.5% threshold so that they can receive the benefit of this deduction, as well.

Outcome: Some taxpayers who previously thought their medical expenses were too low in 2017 for deducting might find they are in fact eligible. If you anticipate major expenses in 2017 or 2018, timing any other discretionary (deductible) medical spending into the same year may be beneficial.

Miscellaneous Itemized Deductions: All miscellaneous itemized deductions that were otherwise subject to the 2%-of-AGI floor have been eliminated. Some of the most common deductions that will be lost are as follows:

- Unreimbursed Employee Expenses, including Office in the Home (not for self-employed)

- Tax Preparation Fees & Investment Fees (including Bluestem fees)

- Safe-Deposit Box Fees

Outcome: In some cases, you may benefit from accelerating these deductions normally paid in 2018 by pre-paying by December 31st of this year. Note, this strategy may not apply to those subject to AMT in 2017.

Paying too much in taxes? Find a tax-focused financial planner

The following post is shared content from the Alliance of Comprehensive Planners.

Tax-focused financial planning is not just for the one percent. On the contrary taxes are the hub of the financial wheel with consequences to virtually all financial decisions. Under-planning and overpaying simply delays financial independence. So, why don’t more Americans engage in tax-focused financial planning?

The disconnect between financial planning and tax planning is costing American taxpayers dearly. Aside from the many who intentionally allow higher withholding throughout the year just to claim a sizeable refund in April, are those who overlook the tax implications of their retirement distributions, investment allocations, estate planning decisions or education savings. All have tax liabilities attached, either in the short or long term.

Accountants and tax preparers might identify those consequences in hindsight, when it’s too late to avoid tax penalties. And, financial advisors,who often simply state, “consult your tax advisor” are just washing their hands of the tax consequences of their advice, leaving it up their client to connect the dots. Indeed, it is this short-sighted, often rear view, of taxes as a once-a-year task, rather than a pervasive feature of financial life, that makes the tax-focused financial planner uniquely positioned to advise clients in all aspects of their financial lives.

“All aspects” is a hefty claim. Yet, tax-focused financial planners are informed not only by their clients’ financial profile, but also by the real context and implications of their advice. Cash flow and financial behaviors, the expectations for children and demands of aging parents, job security and income growth are as important as retirement planning, investment strategy and the tax consequences for the all-of-it. It’s holistic. It’s fiduciary based. And, it’s decidedly uncommon.

Focusing on history, is as bad as ignoring it, and tax preparation is often just that: passive and backward-looking. Tax planning is anticipatory, active and looks forward, sometimes even beyond the current year to future years.

Those knee-deep in regret over the tax return they’re filing in April, might reconsider their approach for 2017. With a tax-focused financial planner, planning for their 2017 tax return would already be underway.

To read more on the subject of tax-focused financial planning check out the Tax Alpha White Paper written by fellow ACP Advisors Jonathan Heller and Robert Walsh (edited by Bluestem’s very own Karen Folk and Jake Kuebler). For more information on the Alliance of Comprehensive Planners visit their website at www.acplanners.org.

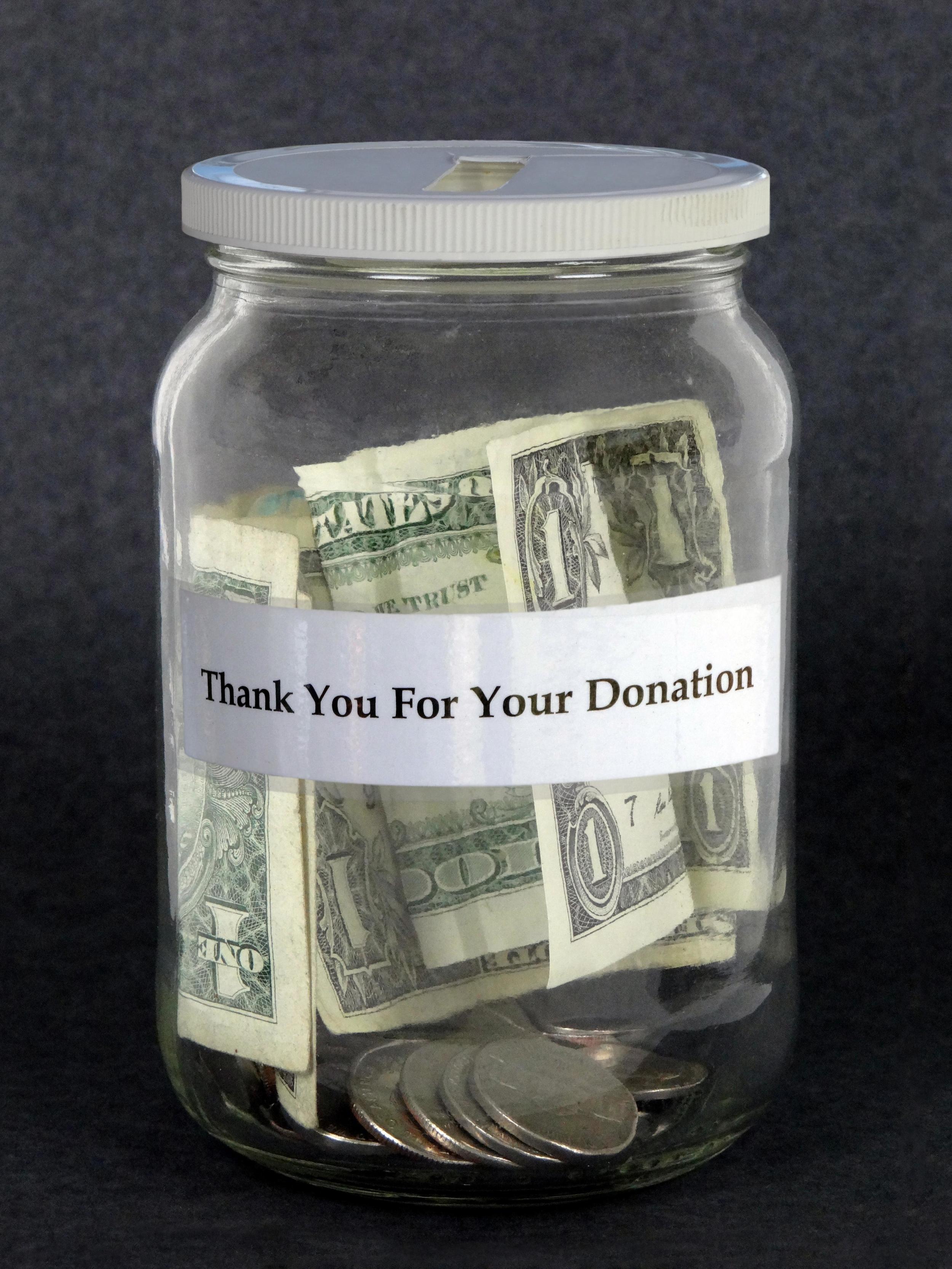

Do you have the right records for Charitable Gifts?

For most of us, getting organized to complete our annual Income Tax Return is a chore. We would prefer to expend the minimum amount of effort to get the job done. Luckily, many records such as income figures are provided to us by others (W-2’s, 1099’s etc). In addition, minimizing your taxes due often involves documenting charitable gifts for itemized deductions. Maximizing the benefits from those charitable gifts does require a bit more work on your part.

While you may be aware that you need to keep records to deduct charitable gifts you make, you may not realize that it is fairly common not to receive IRS-compliant documentation from nonprofit organizations. Therefore, it is up to you to know the rules yourself and confirm you receive the correct documents. Below is an outline of what to keep when you make Charitable Gifts (by donating Cash, Check, via Credit Card, etc):

For Gifts under $250:

You need to have a record showing the name of the organization, date and amount of the contribution. One or the other of these will work:

us, getting organized to complete our annual Income Tax Return is a chore. We would prefer to expend the minimum amount of effort to get the job done. Luckily, many records such as income figures are provided to us by others (W-2’s, 1099’s etc). In addition, minimizing your taxes due often involves documenting charitable gifts for itemized deductions. Maximizing the benefits from those charitable gifts does require a bit more work on your part.

While you may be aware that you need to keep records to deduct charitable gifts you make, you may not realize that it is fairly common not to receive IRS-compliant documentation from nonprofit organizations. Therefore, it is up to you to know the rules yourself and confirm you receive the correct documents. Below is an outline of what to keep when you make Charitable Gifts (by donating Cash, Check, via Credit Card, etc):

For Gifts under $250:

You need to have a record showing the name of the organization, date and amount of the contribution. One or the other of these will work:

- Bank Record such as cancelled check, bank or credit card statement, or

- A receipt from the organization

This means gifts such as putting cash in the Salvation Army Red Bucket are not deductible.

For Gifts of $250 or more: In addition to the record showing the name of the organization, date and amount of the contribution described above, you also need a written acknowledgement from the charity that meets all three of the following requirements:

- The acknowledgement includes the amount of the contribution. and

- It states if any goods or services were received by you in exchange for the gift. (Note: this is required even if no goods or services were received; this is the most commonly missed item we see on charity acknowledgement letters.) and

- The written acknowledgement needs to be received before you file your tax return.

There are documented court cases in which the IRS disallowed deductions made for charitable gifts that would have qualified as deductions, but proper documentation was not provided to the taxpayer by the charitable organization. If you are missing any of the information above, you should reach out to the organization. They may not even be aware of the reporting requirements themselves, especially for a small, volunteer run charity.

For non-cash gifts such as donations of personal items or household goods, shares of investment securities, etc, there are additional recordkeeping requirements to follow. Please be sure to consult IRS Publication 526 or contact us to learn more.

#GivingTuesday

There is no doubt that the holiday season is officially upon us. It is difficult to go out and about and not be inundated with signs for holiday shopping deals. Around every corner is another flashy ad encouraging you to be a good consumer and spend spend spend. That said, there is nothing wrong with holiday shopping and gift giving, but what about giving back in a different way? We have all heard about Black Friday, Small Business Saturday and Cyber Monday, but how many of us are familiar with Giving Tuesday? Giving Tuesday is a nationwide initiative that encourages individuals and organizations to spend the Tuesday after Thanksgiving practicing generosity. So, after you have filled up with food on Thanksgiving, loaded your shopping cart on Black Friday and clicked your way to consumer bliss on Cyber Monday, why not spend Tuesday, December 2nd celebrating generosity by donating to your favorite charities? There are many reasons why people give: altruism, gratitude, recognition, compassion, generosity, the list goes on and so do the benefits. However, one benefit we can all appreciate is the ever famous tax deduction. Recently, Jake Kuebler appeared on WCIA’s Current to discuss charitable deductions and budgeting for charitable giving. For some of Jake’s tips on giving be sure to check out the full segment below.

Bluestem would like to wish you all a very Happy Holiday season!

The Hidden Danger of Large Tax Refunds

It is no secret that many taxpayers use payroll tax withholding as a method of forced savings. Each spring they receive a large refund on their tax return, using the proceeds to fund a vacation, a car down payment, or other large purchase or savings goals. In doing so, they put themselves at more risk than they realize. You have heard the usual arguments against overpaying on your tax return to receive a large refund. There is the opportunity cost, which is the forgone interest you could have earned by saving or investing those funds during the year. Given near zero interest rates on traditional banking products, this loss is small. Most who rely on the large refund technique would argue that the inaccessibility of these funds promotes savings when self-control is not enough.

If there were a substantial risk your refund could be delayed by months or even years, would you change your mind about this strategy? The IRS reports that tax fraud related to stolen identities is on the rise. In one common scam, a thief will file a false return under your social security number and claim a large refund. Once you attempt to file your actual return, the IRS system rejects your claim.

In most tax fraud cases, it takes time to work through the layers of IRS taxpayer bureaucracy and advocacy to substantiate your claim. This process is slow and it can take up to 18 months or more to get your refund. It is not hard to imagine a scenario where a taxpayer who relies on this large annual tax refund is left in a pinch when her refund is delayed. You may be the one stuck with penalties or interest when your delayed refund results in missed payment deadlines for your real estate taxes, credit card bill or other bill you planned to pay with the refund.

This year I encourage you to avoid over-withholding to gain a large refund. Instead, adjust your withholding to a lower level sufficient to pay your expected tax bill. Then, with your larger net paycheck, focus on ways to save out of sight, out of mind. In today’s digital banking era, direct deposits and automatic transfers from each paycheck can easily be setup to force savings.

Getting Organized for Taxes

It is that time of the year when ads for tax software and national tax firms are beginning to appear, reminding us that tax filing season is quickly approaching. Before you get too anxious, remember half the battle is getting organized. To help those whose records are a little scattered, we have compiled some helpful hints in getting organized:

Record Keeping

- Have trouble hanging on to receipts? Opt to pay by check or credit card for easy record keeping. Better yet, if you have lots of deductible expenses, opt for a separate account for deductible versus personal expenses.

- Wonder how long to keep those tax records? Generally the IRS has three years from the due date of your return to audit and ask for more documentation. Be safe and keep everything for 5 years. After that, feel free to toss (or shred) supporting documentation. Keep the return itself forever as you never know when it might come in handy.

Charitable Donations

- Paid Cash & No Receipt? Not deductible. Period.

- Donation of more than $250? Be sure the organization acknowledges the gift in writing AND states that no goods or services were provided in exchange for the gift.

- Do not undervalue your non-cash gifts (Goodwill, Salvation Army, Etc). Use an aid such as Deduct It, Deduct It! to properly value your donated items.

Medical Expenses

- Ask your medical facility and pharmacy for a summary of all expenses incurred during the year. This is a great way to save time adding up receipts.

- Transportation costs to and from medical care are deductible. Keep a log of medical miles with the date, # of miles, and facility visited.

Real Estate

- If you refinanced your home, do not forget mortgage interest for the old loan and the new loan. Even if they are from the same bank, you may get separate reports on interest paid.

- Many counties provide records of Real Estate Tax paid. Champaign County has records available here.

- If you bought or sold your home, closing documents may be needed to determine who (buyer/seller) paid how much in taxes.

Reviewing your prior year return might help remind you of items you may need for this year. If your tax situation is more complicated, such as those with rental properties or consulting income, consider tracking your expenses with programs such as Quicken™ or Mint.com.

Same-Sex Marriages Recognized For Federal Tax Purposes

Yesterday, the US Treasury and IRS ruled same-sex couples legally married in a jurisdiction that recognizes that marriage will be valid for federal tax purposes. This applies whether or not the couple is currently living in a jurisdiction that recognizes the marriage. This ruling clarifies tax filing and benefit questions following the Supreme Court striking down the Defense of Marriage Act (DOMA) in June of this year. You can read the complete ruling here.

What about Illinois Civil Unions?

This ruling does not apply to registered domestic partnerships, civil unions or similar formal relationships recognized under state law, thereby excluding Illinois Civil Unions. However, if you were married in another state or foreign country recognizing same-sex marriages, you may still qualify.

What benefits does this include?

The ruling applies to all federal tax provisions where marriage is a factor. This includes:

- The ability to file a joint tax return and the ability to take personal and dependency exemptions

- Taxation of employee benefits, such as tax free receipt of same-sex spousal health insurance

- Estate and gift taxes, allowing for unlimited tax-free gifts and unlimited marital deduction for estate tax purposes to your same-sex spouse

Can I Amend Prior Tax Returns?

Yes, if you previously filed single or head of household in a year in which you were legally married, you may be eligible to amend the return to change marital status. There are limitations to be aware of. For instance, the statue of limitations general restricts amendments of returns to three years following the original due date of the return. For most couples, this would restrict them to amending only 2010 and beyond. Exceptions may apply for specific circumstances.

What are the next steps?

For our clients who are affected by this ruling, we will be discussing how this applies to you directly and how to adjust your financial and tax plan accordingly.

If you are not a client, but interested in finding more about how your tax situation integrates into your entire financial picture, contact us today!