Since the enactment of the federal income tax, major tax reforms or revisions have come approximately once every generation. The latest was the Tax Cuts and Jobs Act of 2017, also known as “TCJA”. Unlike prior reforms in 1986, this law included a sunset provision which allowed it to pass without threat of the filibuster. The provision requires the changes enacted to be renewed by December 31, 2025, otherwise the law expires, and the tax code reverts to the tax laws prior the enactment of TCJA. As “I’m Just a Bill” from Schoolhouse Rock reminds us, any new legislation would require agreement by both houses of Congress and the President. Given the political deadlock of our current legislators and the forthcoming election, the future is as murky as ever.

While we could spend years exploring the politics of the time, the real question our clients are facing is how to move forward in planning for taxes with an uncertain landscape. The answer is, focus on what we know. Here we’ll explore the impacts that might be seen if TCJA sunsets and tax planning opportunities that might be worth considering.

A Refresher on TCJA

Of all the possible topics around personal finance and financial planning, taxes are arguably the most dreaded. It is as inescapable as death, boring to many, and almost every answer around interpreting tax code includes “it depends”, “except”, and/or “but”. Unfortunately, when it comes to assessing the tax impact of TJCA and its possible expiration, this time is no different. There is no universal answer to “will my taxes go up or down”?

Let’s break down some of the major changes under TJCA and what the rules might look like in the event of a sunset:

Tax Brackets

While looking over your income tax return (Form 1040) might appear complex, the basic tax formula is fairly simple. You add up all your sources of income and then reduce that number by various adjustments and deductions to arrive at taxable income. Your income is then compared to a table to determine tax due. One common misconception is that moving up a tax bracket can have a huge impact on your tax bill by increasing your tax due by 5%, for example. The reality is that everyone pays the same rate of tax on the first dollars of income. As income exceeds a threshold, the next dollar is taxed at the new, higher rate. This concept is known as Marginal Tax Rate. That is, what rate of tax would you pay on the next dollar of income (or save on one dollar of deduction).

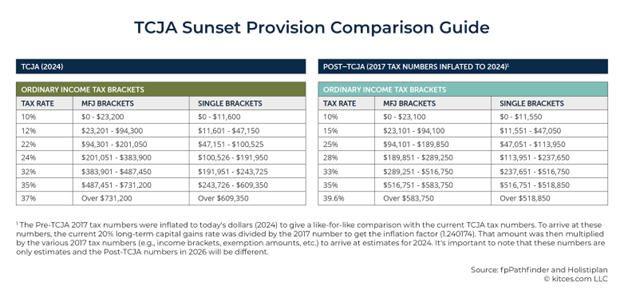

Under TCJA, tax rates were modified by lowering many rates and widening brackets, meaning more income is taxed at a lower rate. This is especially true at the higher brackets. If TCJA were to expire, rates would revert to former brackets. The following is an estimate of this impact by our friends at Holistiplan (provider of tax planning software we utilize):

Example 1:

Jane Smith is a Professor of Chemistry and John Smith is a Professor of Literature. They are both doing well and earned tenure, with current salaries exceeding $100,000. Their net taxable income in 2024 is $200,000 after deductions including retirement and health insurance.

Current 2024 Tax Brackets Calculation:

First $23,200 income at 10%: $2,320

$23,201 to $94,300 at 12%: $8,532

$94,301 to $200,000 at 22%: $23,254

Total Federal Income Tax: $34,106

Post-TCJA Tax Brackets Calculation:

First $23,200 income at 10%: $2,320

$23,101 to $94,100 at 15%: $10,650

$94,101 to $189,850 at 25%: $23,937

$200,000 - $189,851 at 28% = $2,842

Total Federal Income Tax: $39,749

Comparison and Marginal Rate Difference:

Under the current 2024 tax brackets, John and Jane in the marginal tax bracket of 22% and pay $34,106 in taxes.

Under the post-TCJA brackets, their marginal rate increases to 28% and their tax liability would increase to $39,740.

This results in an additional $5,643 in taxes.

Major Deductions and Credits

While it might appear at first glance that taxes will go up for everyone, there are more changes that make the calculations more complex. There were significant changes to the standard deduction and personal exemptions as follows:

Personal Exemptions

TCJA removed personal exemptions as a deduction against taxable income, which was a deduction calculated based on the number of members of your household. If TCJA were to expire, this is expected to return. A single filer might expect an added deduction of around $5,050, a married couple of around $10,100, plus an additional $5,050 per qualified dependent.

Note – Personal exemptions were subject to a phase out for high income earners. This means that prior to TCJA, high income earners (>$300,000 MAGI) were already not getting this deduction.

Itemized Deductions

For those that continue to itemize, there were two major changes to allowable deductions. Those included the addition of a $10,000 cap on state and local income tax deduction (the so-called SALT deduction).

If TCJA were to expire, these deductions would come back allowing more taxpayers to benefit from more itemized deductions. With more allowable deductions, we might also see charitably inclined taxpayers see benefits.

Note – Certain itemized deductions were added back for high income earners under Alternative Minimum Tax (AMT). This means that prior to TCJA, high income earners (>$300,000 MAGI) were not always benefitting from these now disallowed deductions.

Standard Deduction

While TCJA took away the personal exemption and limited itemized deductions as described above, it did increase the standard deduction to offset.

2024 standard deductions start at $14,600 for single and $29,200 for married filing joint

Projected standard deductions if TCJA expired would be $7,850 for single and $15,750 for married filing joint

Exemption / Deduction Impacts

The net result is each taxpayer would be impacted differently under a post-TCJA system. Some common examples of who might be impacted include:

Large Families – Families with multiple kids may see their personal exemptions increase, which would result in lower taxable income.

High Taxed States – Those living in states with income taxes and/or higher real estate taxes might see the return of their ability to itemize, especially those with a mortgage!

Unreimbursed Employee Expenses – This falls under the miscellaneous category of itemized deductions and allowed a deduction of unreimbursed employee expenses in some circumstances. This was commonly used by our academic clients to deduct housing and food costs while traveling on sabbaticals. This category also includes deductibility of tax preparation, investment, and financial planning fees.

High Earners – Under the pre-TCJA tax rules, often the personal exemptions and SALT deductions were disallowed under various phase outs and alternative minimum tax calculations. Some high-income earners might see higher deductions that end up getting offset or eliminated under a post-TCJA world.

Child Tax Credit

To further offset the impacts of changes to itemized deductions and exemptions, TCJA increased tax credits for children and dependents. This increased the child tax credit from $1,000 to $2,000 and added a new dependent tax credit for older dependents worth up to $500 per dependent.

Example 2:

To illustrate let’s revisit the facts from Example 1. Assume instead that Jane and John’s adjusted gross income (before deductions and exemptions) is $200,000. They also have two kids aged eight and six. They have $9,500 in state income taxes, and own a home with a mortgage and interest of $7,200 and real estate taxes of $8,000.

Current 2024 Tax Brackets Calculation:

Adjusted gross income: $200,000

Standard deduction: $29,200 (less than itemized deductions of $10,000 SALT and mortgage interest of $7,200)

Exemptions: $0

Taxable income: $170,800

Gross federal income tax: $27,682

Child tax credit: $4,000

Gross federal income tax: $23,682

Post-TCJA Tax Brackets Calculation:

Adjusted gross income: $200,000

Itemized deduction: $24,700 (higher than the new standard deduction of $15,750)

Exemptions: $20,200

Taxable income: $155,100

Gross federal income tax: $29,220

Child tax credit: $2,000

Gross federal income tax: $27,682

Small Business Owners

A much-publicized impact of TCJA was cutting taxes on businesses. Corporate taxes are beyond the scope of this discussion, but many businesses are smaller and reported on personal income tax filings. To pass on this savings to small business, TCJA rolled out the qualified business income deduction (QBID). This allowed for a 20% deduction for qualified business income, though notably did phase out for certain service businesses when income exceeded $191,950 (single) / $383,900 (MFJ).

Tax Planning Impacts

As you can see, there are many impacts to the tax calculations that would be impacted by the sunsetting of TCJA. There is no one-size-fits-all strategy because there are multiple possible outcomes and each taxpayer’s unique circumstances may impact the impact.

For example, when it comes to TCJA, we know there are at least three potential outcomes:

TCJA is extended, which would suggest that tax rates would stay about the same.

TCJA is not extended, which means tax rates may increase OR decrease based on your own facts and circumstances.

TCJA is replaced with entirely new or different legislation, which may also increase OR decrease based on your own facts and circumstances.

Further, we find that our clients’ lives are rarely static. Life is changing all the time. These changes might impact future income or deductions and, in return, the tax rates likely to be paid in the future. For example, we often see expectations of:

Future promotions, growth of a business, inheritances, or starting a pension or social security benefits resulting in higher expected taxes down the road.

Future from the sale of a business, career changes, or retirement resulting in lower expected taxes down the road.

To really plan, you need to consider how both the potential scenarios above might impact your own tax situation.

Example 3:

Continuing the from Examples 1 and 2, imagine that Jane currently holds a patent on a promising piece of technology that is undergoing final licensing agreements with a private company. The licensing agreement includes a provision for ongoing consultation at $100,000 per year for 10 years plus a percentage of the revenue generated from the product. No matter the outcome of TCJA, income will likely grow for many years to come and likely to result in a higher marginal tax rate down the road.

Example 4:

Imagine instead a retiree, Susan, age 75. Her income is relatively predicable from pension, social security, and some investment income. These sources of income are unlikely to change in the foreseeable future. If TCJA is extended, her tax rate will not likely change. If TCJA is not extended, her tax rate may increase somewhat. This makes it likely that if she chooses to accelerate future income by converting IRA to Roth IRA, she may avoid higher rates. If rates do not change, she is unlikely to be worse off as she paid tax at the same rate she would have paid if that income was deferred.

Strategies for Tax Planning

If you expect your future tax rates to be higher, you might consider:

Accelerate Income: Consider strategies saving more to Roth type retirement plans (vs. traditional pre-tax plans), converting traditional IRAs to Roth IRAs, and recognizing income from businesses earlier.

Defer Deductions: Wait when possible to pay deductible expenses, such as medical expenses or charitable contributions, to benefit from future higher tax rates.

If you expect your future tax rates to be lower, you might consider:

Defer Income: Delay income where possible, such as maximizing pre-tax retirement savings opportunities, deferring distributions from retirement accounts, avoiding sales of assets taxed at ordinary tax rates.

Accelerate Deductions and Credits: Prepay deductible expenses, such as medical expenses or charitable contributions, to benefit from current tax rates.

Conclusion

As we approach the sunset of the Tax Cuts and Jobs Act in 2025, the potential impacts on individual taxes are highly personalized and contingent on numerous factors. Whether your taxes will increase or decrease depends on your unique financial situation, including income, deductions, and credits. Therefore, it is essential to work with your tax advisor to understand how the changes may affect you personally. At our firm, we help our clients navigate these complexities to plan effectively for their specific circumstances.

Resources - TCJA Sunset Provision Comparison Guide - Co-Marketing - Holistiplan - 2024 (fppathfinder.com)