As you may have seen, the House and Senate have reconciled a final version of the Tax Cuts and Jobs Act of 2017 which President Trump signed into law this morning. While the bill has been signed it is important to note that additional time will be needed for full interpretation and adjustments as corrections and revisions are expected.

While a significant portion of tax changes relates to business organizations, many changes will affect individual taxpayers, as well. With such a major restructuring, it will likely take months for all of the changes to be ironed out.

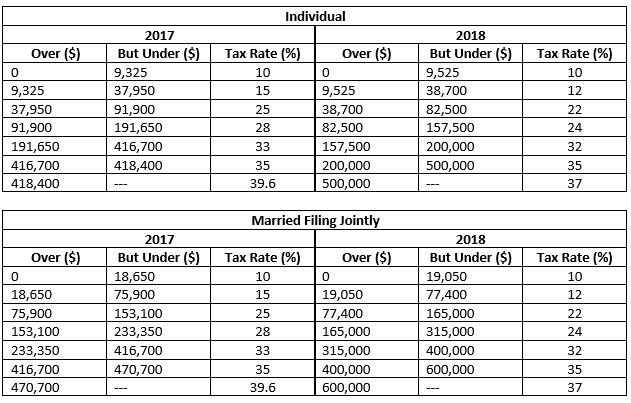

Tax Brackets: The revised tax plan retains a 7 bracket tax system as proposed by the Senate. Most of the brackets enjoy a decreased rate, although the ranges of taxable income that define each bracket have been significantly adjusted. Below are the new tax rates compared to 2017. The table can be used to estimate how your tax rate may change in 2018.

Outcomes: It is nearly impossible to generalize who will see increases or decreases by this change alone. High-income couples will see some relief from the so called “marriage penalty”, up to $600,000 of taxable income. Otherwise, you will need to reference the following changes to fully gauge impact on your taxable income (impacting how these rate changes affect you). Many people will see lower overall rates, but loss of deductions may increase others overall tax liability.

Standard Deduction and Personal Exemptions: The standard deduction for all taxpayers has nearly doubled from $6,350 to $12,000 for individuals and from $12,700 to $24,000 for married couples. However, simultaneously is an elimination of personal exemptions of $4,050 per family member.

Outcome: An increased standard deduction will limit the benefit for many taxpayers to itemize deductions. Individuals and married couples with no kids and minimal itemized deductions may see a slight decrease in tax, while larger families may see higher tax due to the loss of personal exemptions. Keep in mind, changes to the Alternative Minimum Tax (AMT) may impact these changes for your situation.

Child Tax Credit: The Child Tax Credit is being expanded with an increase from $1,000 to $2,000 per qualifying child under 17. Also, the income phaseout levels are increased from $75,000 to $200,000 for individuals and $110,000 to $400,000 for married filing jointly. Additionally, a new credit of $500 has been added for qualified dependents that are not qualifying children (children 17 and older or non-child dependents such as parent).

Outcome: Intended to make up for the lost benefit of personal exemptions, individual results may vary based on family size, age of dependents, etc. Higher income taxpayers may benefit the most as they may have previously seen no benefit from personal exemptions due to AMT while now being eligible for the expanded Child Tax Credit.

Itemized Deductions

Mortgage Interest Deduction: For new mortgage contracts following December 15, 2017, the deductibility of interest on a primary residence will be limited to the first $750,000 of debt principal, as opposed to the current limit of $1,000,000. Interest deductibility on Home Equity Lines of Credit (HELOC) will be eliminated for existing and new loans when funds are not used to buy, build, or significantly improve the primary residence.

Outcome: Mortgage and HELOC interest remains a useful tax strategy for many taxpayers that will still be itemizing. We will simply need to be extra diligent about keeping record of how HELOC funds are used.

Charitable Contributions: While relatively unchanged, the limit for deducting cash donations to charities is being increased from 50% to 60% of Adjusted Gross Income.

Outcome: With the increased standard deduction, more individuals may see a benefit in “bunching” their charitable gifts on an every-other-year strategy.

State and Local Tax Deduction: Originally, both the Senate and the House looked to either eliminate or severely reduce these deductions. The final version of the bill allows both deductions but at a combined cap of $10,000. The cap is the same for both individual and married filing jointly returns. Furthermore, any pre-paid 2018 State income tax will not be allowed on 2017 tax returns.

Outcome: The cap on these deductions may limit the benefitting of itemizing deductions for some taxpayers, especially in the greater context of all the changes going into effect. Some people may benefit from pre-paying certain taxes before 12/31/2017. If you make estimated tax payments, you might benefit from pre-paying your 4th Quarter State estimated tax payment before the end of 2017. For those of you who live in a county that accepts prepayments for real estate taxes, you may also benefit from pre-paying your real estate taxes. Please note, many high-income taxpayers subject to AMT may not benefit the prepaying strategies. However, those same taxpayers will not also see a tax increase due to changes as their deductibility was already limited.

Medical Expense Deduction: Surprisingly, the medical expenses deduction will be temporarily expanded. For tax year 2018 and retroactively for 2017, the AGI threshold for this deduction will be reduced from 10% to 7.5%. An additional adjustment allows taxpayers affected by AMT to still enjoy the 7.5% threshold so that they can receive the benefit of this deduction, as well.

Outcome: Some taxpayers who previously thought their medical expenses were too low in 2017 for deducting might find they are in fact eligible. If you anticipate major expenses in 2017 or 2018, timing any other discretionary (deductible) medical spending into the same year may be beneficial.

Miscellaneous Itemized Deductions: All miscellaneous itemized deductions that were otherwise subject to the 2%-of-AGI floor have been eliminated. Some of the most common deductions that will be lost are as follows:

- Unreimbursed Employee Expenses, including Office in the Home (not for self-employed)

- Tax Preparation Fees & Investment Fees (including Bluestem fees)

- Safe-Deposit Box Fees

Outcome: In some cases, you may benefit from accelerating these deductions normally paid in 2018 by pre-paying by December 31st of this year. Note, this strategy may not apply to those subject to AMT in 2017.