Disability insurance is often overlooked and, in many cases, more important than life insurance. This is something that we stress with our clients when reviewing their risks and insurance needs. Open Enrollment for Supplemental Long-Term Disability Benefits through March 10, 2023!

SECURE ACT 2.0 – The Hits Keep on Rollin'

Charging Ahead with Electric Vehicles

Insurance Changes for Illinois State Retiree Health Insurance

In September, the State of Illinois Department of Central Management Services (CMS) announced changes to the State of Illinois Retiree Insurance Program. These changes impact retirees enrolled in the Total Retiree Advantage Illinois (TRAIL) who are also Medicare Eligible. This applies to members who are currently enrolled, or plan to enroll in the TRAIL Medicare Advantage Prescription Drug (MAPD) plan effective for the 2023 plan year.

Following a proposal process, the State of Illinois has selected Aetna Medicare Advantage Prescription Drug (MAPD) PPO Plan as the new medical and prescription drug plan beginning January 1, 2023. This will replace the existing plans, most commonly the HMO Plans through UnitedHealthcare, Health Alliance, or Humana. This change is automatic and does not require participants to take any action .

Here are a few Frequently Asked Questions (FAQs) that may help you:

Why is this change happening?

The contract with current providers expires December 31, 2022. State law requires a competitive process to compare proposals submitted by various vendors. Aetna was selected as part of this process.

With any change in insurance provider also comes concern over coverage of existing doctors and hospitals. While it is yet to be seen how these concerns will be addressed, it is worth noting this is not a new process. A similar process unfolded when Health Alliance was dropped in exchange for UnitedHealthcare.

Can I maintain my current Medicare Advantage Plan Provider?

No. To maintain coverage under the Total Retiree Advantage Illinois (TRAIL), including subsidized premiums under your retirement annuity, you and your dependents will automatically change to the new provider.

You may opt of out of TRAIL by visiting MyBenefits.illinois.gov. This must be completed by November 30, 2022. If you opt out, you will want to select a new Medicare Supplement and Part D or Medicare Advantage plan in the private market. You will be responsible for the full premiums for these Supplement/Advantage plans. You can compare plans at Medicare's Website. If you opt out, you may re-enroll in the TRAIL program with a qualified life event or during the next year’s open enrollment.

What if I am not Medicare Eligible?

This change only impacts members and their dependents whose coverage is under a Medicare Advantage plan. If you or any dependents are not Medicare-eligible, your coverage is through the State Employees Group Insurance Program (SEGIP) and is not impacted by this change. This change may impact you if you become Medicare eligible in the future.

What is a Medicare Advantage Plan?

Medicare is commonly made up of three parts:

Part A – Covers Hospital Services

Part B – Medical Insurance

Part D – Prescription Drugs

Most Medicare participants also add a Medicare Supplement plan to cover any gaps and add services above the base Medicare plans.

Medicare Advantage Plans combine all the above plans into a single plan, administered through a private health insurance company. In this case, Aetna is the private company who will take over administration.

Do I pay Medicare Premiums if I am enrolled in a Medicare Advantage Plan?

Yes. While a Medicare Advantage plan replaces original Medicare, you are still responsible for Medicare Part B premiums, which are either paid directly to Medicare or deducted from Social Security benefits. Note that, for most people, Medicare Part A is free (paid through Payroll taxes while working). Your Part B premium is based on your income and can change from year to year. Part D may also have a supplemental cost. These premium adjustments are called the Income Related Monthly Adjustment Amounts (IRMAA) as follows:

What’s Next for Me?

As mentioned previously, for those opting out, actions will need to be taken. For those choosing to stay on the TRAIL MAPD program, the change is automatic for members and their dependents. You will receive a welcome kit in the mail from Aetna with more information on the plan and new member ID Cards. With all the Medicare spam mail that gets sent out, keep a sharp eye out for any correspondence from AETNA, CMS, or anything with the TRAIL logo.

Further Reading and Sources:

SURS News Release Retiree Healthcare Update - SURS

Illinois Central Management Services My Benefits Website

Aetna Coverage Details State of Illinois | Aetna Medicare

Medicare Premiums Detail at Social Security - IRMAA Sliding Scale Tables

TRAIL Enrollment Guide (2022) FY 2022 Benefit Choice

SURS Self-Managed Transitions to SURS Retirement Savings Plan

Tax Cuts and Jobs Act of 2017

As you may have seen, the House and Senate have reconciled a final version of the Tax Cuts and Jobs Act of 2017 which President Trump signed into law this morning. While the bill has been signed it is important to note that additional time will be needed for full interpretation and adjustments as corrections and revisions are expected.

While a significant portion of tax changes relates to business organizations, many changes will affect individual taxpayers, as well. With such a major restructuring, it will likely take months for all of the changes to be ironed out.

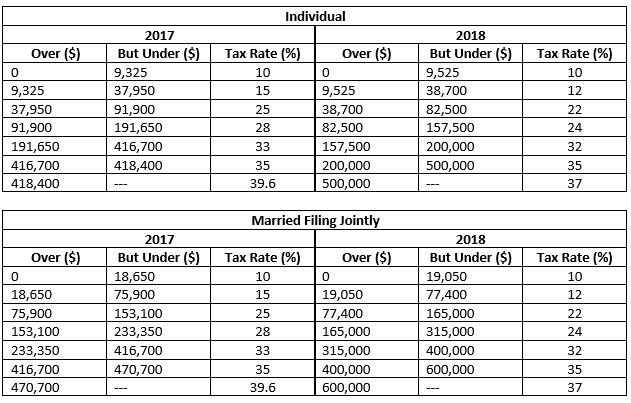

Tax Brackets: The revised tax plan retains a 7 bracket tax system as proposed by the Senate. Most of the brackets enjoy a decreased rate, although the ranges of taxable income that define each bracket have been significantly adjusted. Below are the new tax rates compared to 2017. The table can be used to estimate how your tax rate may change in 2018.

Outcomes: It is nearly impossible to generalize who will see increases or decreases by this change alone. High-income couples will see some relief from the so called “marriage penalty”, up to $600,000 of taxable income. Otherwise, you will need to reference the following changes to fully gauge impact on your taxable income (impacting how these rate changes affect you). Many people will see lower overall rates, but loss of deductions may increase others overall tax liability.

Standard Deduction and Personal Exemptions: The standard deduction for all taxpayers has nearly doubled from $6,350 to $12,000 for individuals and from $12,700 to $24,000 for married couples. However, simultaneously is an elimination of personal exemptions of $4,050 per family member.

Outcome: An increased standard deduction will limit the benefit for many taxpayers to itemize deductions. Individuals and married couples with no kids and minimal itemized deductions may see a slight decrease in tax, while larger families may see higher tax due to the loss of personal exemptions. Keep in mind, changes to the Alternative Minimum Tax (AMT) may impact these changes for your situation.

Child Tax Credit: The Child Tax Credit is being expanded with an increase from $1,000 to $2,000 per qualifying child under 17. Also, the income phaseout levels are increased from $75,000 to $200,000 for individuals and $110,000 to $400,000 for married filing jointly. Additionally, a new credit of $500 has been added for qualified dependents that are not qualifying children (children 17 and older or non-child dependents such as parent).

Outcome: Intended to make up for the lost benefit of personal exemptions, individual results may vary based on family size, age of dependents, etc. Higher income taxpayers may benefit the most as they may have previously seen no benefit from personal exemptions due to AMT while now being eligible for the expanded Child Tax Credit.

Itemized Deductions

Mortgage Interest Deduction: For new mortgage contracts following December 15, 2017, the deductibility of interest on a primary residence will be limited to the first $750,000 of debt principal, as opposed to the current limit of $1,000,000. Interest deductibility on Home Equity Lines of Credit (HELOC) will be eliminated for existing and new loans when funds are not used to buy, build, or significantly improve the primary residence.

Outcome: Mortgage and HELOC interest remains a useful tax strategy for many taxpayers that will still be itemizing. We will simply need to be extra diligent about keeping record of how HELOC funds are used.

Charitable Contributions: While relatively unchanged, the limit for deducting cash donations to charities is being increased from 50% to 60% of Adjusted Gross Income.

Outcome: With the increased standard deduction, more individuals may see a benefit in “bunching” their charitable gifts on an every-other-year strategy.

State and Local Tax Deduction: Originally, both the Senate and the House looked to either eliminate or severely reduce these deductions. The final version of the bill allows both deductions but at a combined cap of $10,000. The cap is the same for both individual and married filing jointly returns. Furthermore, any pre-paid 2018 State income tax will not be allowed on 2017 tax returns.

Outcome: The cap on these deductions may limit the benefitting of itemizing deductions for some taxpayers, especially in the greater context of all the changes going into effect. Some people may benefit from pre-paying certain taxes before 12/31/2017. If you make estimated tax payments, you might benefit from pre-paying your 4th Quarter State estimated tax payment before the end of 2017. For those of you who live in a county that accepts prepayments for real estate taxes, you may also benefit from pre-paying your real estate taxes. Please note, many high-income taxpayers subject to AMT may not benefit the prepaying strategies. However, those same taxpayers will not also see a tax increase due to changes as their deductibility was already limited.

Medical Expense Deduction: Surprisingly, the medical expenses deduction will be temporarily expanded. For tax year 2018 and retroactively for 2017, the AGI threshold for this deduction will be reduced from 10% to 7.5%. An additional adjustment allows taxpayers affected by AMT to still enjoy the 7.5% threshold so that they can receive the benefit of this deduction, as well.

Outcome: Some taxpayers who previously thought their medical expenses were too low in 2017 for deducting might find they are in fact eligible. If you anticipate major expenses in 2017 or 2018, timing any other discretionary (deductible) medical spending into the same year may be beneficial.

Miscellaneous Itemized Deductions: All miscellaneous itemized deductions that were otherwise subject to the 2%-of-AGI floor have been eliminated. Some of the most common deductions that will be lost are as follows:

- Unreimbursed Employee Expenses, including Office in the Home (not for self-employed)

- Tax Preparation Fees & Investment Fees (including Bluestem fees)

- Safe-Deposit Box Fees

Outcome: In some cases, you may benefit from accelerating these deductions normally paid in 2018 by pre-paying by December 31st of this year. Note, this strategy may not apply to those subject to AMT in 2017.

Protect Your Identity Following the Equifax Security Breach

Data security has been a hot issue for some time, however, the latest security breach at Equifax has left nearly half of all Americans exposed. In the wake of this troubling incident, many of us are left with questions pondering the safety of our personal information, and even our identity.

How could this security breach have happened?

Unfortunately, the best information we have received from Equifax is that the breach was due to a “website vulnerability”. What exactly this means is anyone’s guess. The important issue now is for all of us to protect ourselves in the safest manner possible.

What can someone do with my personal information?

To name a few of the numerous and frightening possibilities, an identity thief can open a line of credit, take out a prescription, and obtain a driver’s license. The results of the above theft include a ruined credit score, altered medical history, and costly tickets that could lead to a warrant for your arrest. This may sound very doom and gloom, but it’s a good reminder to stay alert and vigilant on all fronts.

What are the odds my identity would be stolen?

The likelihood of becoming a victim of identity theft may not appear to be very high. However, according to a recent USA Today article, 2016 saw a record rate of identity theft - about 1 in every 16 U.S. adults were victims¹. With the sheer volume of data stolen in the recent breach, one can only expect this number to rise in the coming years. Unfortunately, it has increasingly become a question of not if, but when one may be affected by identity theft. Nevertheless, there are several actions available to keep your identity as safe as possible.

To begin, Equifax has offered one year of free credit monitoring service to all individuals, the details of which you can review here. There has been concern raised regarding your ability to pursue legal action against Equifax if you accept this service. In a 9/11/17 update from Equifax, they state that enrolling does not waive any rights to take legal action, and that language on the contrary has been removed from their Terms of Use. However, if you are uncomfortable enrolling with in Equifax’s credit monitoring, see our three trusted steps below. Then continue reading for our general security tips. For maximum protection and security, complete all steps as often as recommended.

First: Routinely check your credit reports and account activity

- Free copies of your credit report are available once a year from each of the three main credit reporting agencies – Equifax, Experian, and TransUnion. They can be requested online here. Review these reports at intervals throughout the year. If any unusual activity is found, contact the credit agency immediately. As a service to our clients, Bluestem requests these free reports on a rotating schedule each year.

- Take some time to review bank and credit card statements once a month. Contact the financial institution if you do not recognize any transactions, no matter how small.

Second: Place a Fraud Alert on your credit reports

- Contact any one of the three credit agencies to inform them you are concerned about becoming a victim of identity theft and ask for a fraud alert. That agency must forward the alert to the other two agencies.

- The alert will require any third party to take measures to confirm your identity before opening any new accounts in your name. This should include contacting you.

- The alert will last for 90 days and can be renewed as many times as you would like. It is a free service.

- If you have already been a victim of identity theft, you can request an extended fraud alert that lasts for 7 years. Alternatively, if you are in active duty with the military, you can request a fraud alert for 1 year to protect you while deployed.

Third: Place a Credit Freeze on your credit reports

- While once thought of as an extreme measure to protect your identity, a credit freeze may be the best way to protect against identity theft given the likelihood your personal information was stolen in the recent breach.

- When placing a credit freeze, you must complete with all three credit agencies separately. When needing to apply for a legitimate credit account, you will have to unfreeze your credit report with all three agencies.

- There is typically a fee for both freezing and unfreezing your credit report, ranging from $3 to $10. The fee differs by credit agency, as well as by state. It is free for victims of identity theft and for individuals 65 years of age or older.

- The three credit agencies also have credit report products that are intended to help you control your credit. Be wary, however, as these products typically cost a monthly subscription fee which can become quite expensive.

Contact information for the Credit Reporting Agencies

TransUnion

1-800-680-7289

Experian

1-888-397-3742

Equifax

1-888-766-0008

General Safety Tips

- Fraudulent tax return filings have been on the rise. A good way to prevent this is to file your return early. The best protection is to obtain an IRS Identity Protection (IP) PIN number. Unfortunately, not everyone is eligible for an IP PIN; you must have either been a victim of identity theft or received a CP01A notice from the IRS. If you do apply for an IP PIN, remember that it will be required to file your tax return each year.

- Update passwords regularly, make them complex, and avoid using the same password for multiple logins. Consider using a password manager such as LastPass to help with password management.

- When available, use dual factor or multi factor authentication to the greatest degree possible. This ensures that even if your password is hacked you will have an additional layer of security.

- Do not send sensitive information such as account numbers or social security numbers via email.

- Be cautious of links included in emails. Do not click on links in emails or enter your credentials in pages linked from an unknown sender. Instead, go directly to the website and manually type the address or search on the site.

- Do not use security questions that have easily searchable or generic answers.

- Do not use public Wi-Fi if at all possible. Hackers can use software that captures every character you type. It is best practice to never access secure websites or email on a public Wi-Fi network.

- If you store any sensitive information such as social security numbers, credit card numbers, account numbers, etc., in external storage devices, ensure that the data is encrypted and in securely password-protected documents.

If you have been the victim of identity theft visit the Federal Trade Commission’s ID Theft website for thorough tips on how to respond.

___________________________________________________________

1 USA Today article by author Bob Sullivan and published on February 6, 2017. (https://www.usatoday.com/story/money/personalfinance/2017/02/06/identity-theft-hit-all-time-high-2016/97398548/).

Illinois’ Budget and Changes to SURS (2017)

This month marks passage of the first Illinois state budget in over two years. The biggest changes resulting from this budget are to the Illinois tax code. Effective July 6th of this year (and retroactive to July 1st), the individual income tax rate has been increased to 4.95% along with other modifications to corporate tax and lesser used tax credits. Details of this bill are still coming, but we do know that this bill also requires changes to the State University Retirement System (SURS) Plan.

Under SB 0042 – Fiscal Year 2018 Budget Implementation Act, SURS is directed to create a new Tier III plan. All new employees hired who first become participants of SURS after the effective date of this new plan will have the choice of this new Tier III plan, the current Tier II plans (Traditional or Portable), or the Self-Managed Plan (SMP). SURS needs to work out many of the details for this new Tier III plan and formally adopt the changes before implementation. Therefore, we do not know the effective date at this point.

Further, existing employees in Tier II will also have the option to opt into Tier III, but the choice would be irrevocable. If you are uncertain which Tier plan you are in, Tier I generally applies to participants enrolled in a SURS Portable or Traditional pension plan before January 1, 2011. Everyone employed after this date is generally Tier II. The new Tier III pension plan would not affect those in Tier I plans or those who chose the Self-Managed Plan (SMP).

The overall goal of this Tier III program is the creation of a hybrid plan – a cross between a defined benefit and defined contribution pension system. In other words, it acts like a mix between the features of the Traditional/Portable Plans and the SMP Plan. Under Tier I and Tier II, the Traditional & Portable Plans are considered Defined Benefit pension plans. In these plans, the employer assumes all of the investment risk. The retirement income that you will receive is determined by a formula that takes into consideration your earnings and length of service. The SMP Plan is a Defined Contribution plan. The employer contributes a pre-determined percentage of your earnings to the SMP plan on your behalf. Those funds are deposited into your account to be invested at your direction (self-directed). This means you are responsible for selecting and managing the investments now and into the future. Your future retirement income depends on the balance of your SMP account at retirement.

Under this newest hybrid Tier III plan, you would get a combination of the two plan features above, albeit with a lower benefit from each. As laid out in the budget bill, the main features of the two components of the Tier III plan are:

Tier III Defined-Benefit Portion would include a pension based on:

- Final Average Salary (FAS) x Years of Credit x 1.25%. This is less than the 2.2% of FAS used in Tier I and Tier II calculations. The reduced pension benefit is designed to be supplemented by the additional savings in the required defined benefit contributions account described below.

- (FAS) equals the average monthly (or annual) salary during the period of service in which earnings were the highest during the last 120 months (or 10 years) of service. In contrast, Tier I uses the highest four consecutive years for FAS and Tier II uses the highest 8 consecutive years in the past 10 years of service (or equivalent highest consecutive earnings months).

- Earnings are only considered and included up to the federal Social Security Wage Base ($127,000 in 2017). This is actually higher than the Tier II plan earnings inclusion which is capped at $111,571.63 (in 2016, adjusted annually). Tier I pensions have no cap on salary earnings included in the FAS final average salary calculation.

- Retirement age under Tier III will be based upon normal Social Security retirement age. This means that retirement age of 67 (with 10 years of service credit) will apply to most participants. It is still unclear if there will be provisions for early retirement options for those who have attained more years of service.

- Employee contributions are equal to the lower of 6.2% of salary or the normal cost of pension benefits. This seems to imply that if the actuarial cost of a Tier III pension benefit is lower than 6.2% of salary, employee contributions may be less than 6.2%. More details are needed to evaluate this.

Tier III Defined-Contribution Portion would have the following provisions:

- Employee contributions of at least 4% of salary to this plan. Combined with the Defined Benefit Contribution, total employee contributions could be as high as 10.2%. This is higher than the 8% contribution rate currently required under Tier I and Tier II. However:

- Whatever the employee contributes, the Employer will match. The language states this employer match may be no higher than 6% of salary and no lower than 2% of salary. This will give each university flexibility to set up a higher match in an effort to attract talent and compete against other public and private employers; albeit coming from the respective university’s (or department’s) budget.

- The employer contributions do not start until after one year of employment, but at that point are 100% vested for the participant.

- Employer and employee contributions would be invested in a separate account maintained by SURS. Likely it would be the same or similar investment choices we currently see under SURS SMP.

Another big change in the budget bill shifts responsibility for funding the SURS employer contributions from the State of Illinois to each university. While increasing university budget expenses, this change will have a smaller impact directly on employees in the SURS system than the new Tier III hybrid plan.

While Tier I participants are not affected by the SURS changes, there are more proposed bills in the pipeline that may affect all SURS pension plan participants. One bill currently under consideration aims to slash the SURS pension Cost-of-Living Adjustment (COLA). To avoid the diminishment of benefits rule, it would offer defined benefit pension plan members a choice to keep their current COLA, but lose all rights to future increase in pension benefits as their salary increases; OR take a reduced COLA in exchange for continued accrual of future pension benefits and lower employee contributions. In other words, you could keep the COLA but lose future accrual of a higher initial pension or take a reduced COLA for continued benefit accrual. Additionally, the proposed legislation appears to offer lump sum buyouts to entice current members out of the SURS defined benefit plans. However, this bill has not passed yet and it is too uncertain to make predictions.

In all cases, there are still many details left before decisions can be made. We know changes are coming for new employees. Existing employees under Tier II Traditional or Portable plans will likely face an irrevocable choice to stay in Tier II or move to the new Tier III hybrid plan. However, SURS needs to make final plans before any analysis can be done. We will continue to monitor and keep our clients informed when changes will affect them.

For more information on the legislation discussed in this post click here.

To view our previous blog post on SURS plan selection click here.

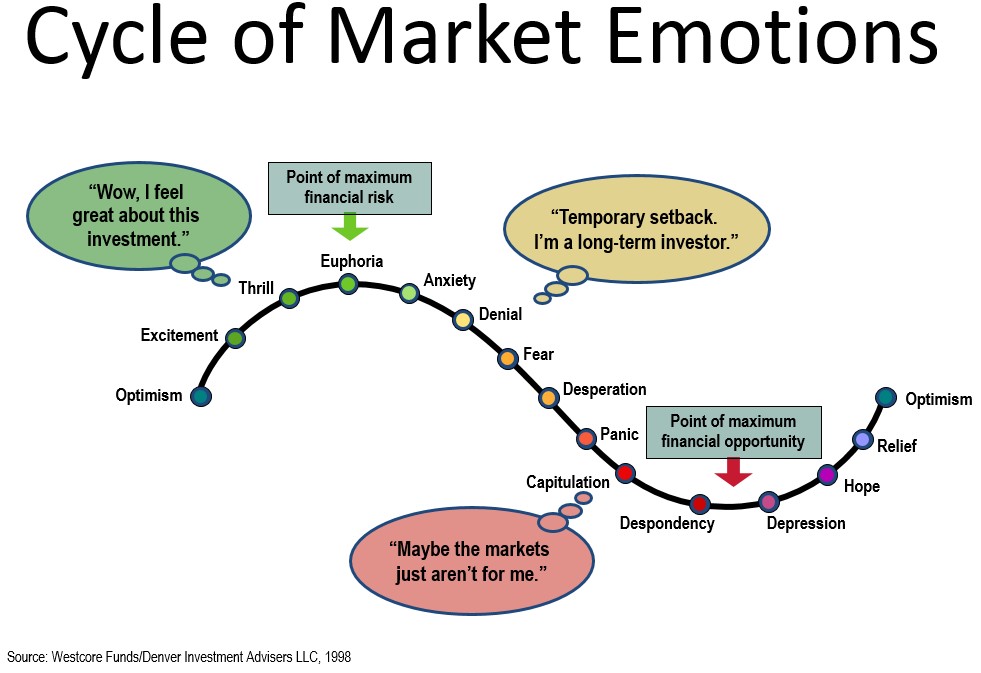

Cycle of Market Emotions

You are probably aware of the stock market activity over the past week. Friday saw the largest drop of the week, rounding out weekly losses in the 5-6% range. This, in turn, fueled massive negative media coverage over the weekend. No doubt, the negative news adds to fears and is one of many factors leading to further losses in the market. As usual, we encourage you to hold steady through the current market gyrations. One soundbite repeated over the weekend news cycle is that the market has not seen a single day drop like Friday’s since 2011. Do you remember which day it was? My guess is that, unless the last drop significantly affected your life or financial plans, the answer is no. The uncertainty of the future can be scary. Our natural first reaction is fear and trying to avoid further losses. Our brains are hardwired to react this way. However, acting on this emotion would be a mistake. It would lead to selling when the market is low, when in reality, that is the complete opposite of the approach you should be taking. The chart below illustrates this.

I predict one of two possible outcomes of the market in the next year:

1. The market will continue to decline as the world economy sorts through its current concerns. For our retiree clients, they will ride the downturn relying on the safety of their bond ladders without fear of where their next paycheck is coming from. For our working clients, they will keep working, contributing regularly into the market and buying stocks while they are on fire sale. Over the long term, the market will recover!

2. The market will recover in the next few weeks and we will quickly forget about the conditions of the past week.

Cycles such as the one we are currently experiencing are part of investing. Doing nothing when the market is getting a little haywire may seem counterintuitive or that we are avoiding the problem. The reality is that sticking to a long term plan through market changes takes resolve and commitment to the stated investment goals. Fighting instinct is hard, but doing so leads to better investment performance in the long run and, more importantly, a better chance of realizing your financial goals.

Supreme Court Rules Illinois Pension Reforms Unconstitutional

The Illinois Supreme Court ruled today that Illinois State Pension Reform signed into law in 2013 is unconstitutional. This ruling does not come as a surprise. Previous rulings on healthcare indicated the court would interpret constitutional protection in favor of participants and strike the reform down. What does this mean to me?

Immediately, participants will not notice any major changes. With court challenges to the original reforms, implementation of reforms had already halted in 2014. This means none of the changes designed to reduce benefits or change contributions had been implemented. This applies to both those who are active participants and retirees.

Longer term, it is still unclear what will happen. Reforms were enacted to plug massive state budget deficits. The fiscal situation of the state is still dire. Current Governor, Bruce Rauner, has stated he intends to move forward with new reforms. It is unclear exactly what these changes look like, but proposals have included:

- Shifting future pension costs to local governments and universities

- Changing the way in which future pension benefits accrue

- Moving from defined benefit type (pension) plans to defined contribution (401k style) plans

Since a majority of Bluestem's clients are current participants or retirees of the State University Retirement System (SURS) or other Illinois Pension Systems, we will continue to monitor this situation. Planning during this time will continue to be a challenge as proposals will be a moving target until passed into law. As always, contact us if you would like an individual review of your retirement plan.

Update on State Employee Retiree Health Insurance Premiums

The following is an update to previous postings regarding State of Illinois Pension Reform and Insurance for retirees. You can read those prior posts here. Following a court ruling that the State of Illinois wrongly withheld premiums for health insurance from retiree pension payments, members of the State’s five pension systems, including the State University Retirement System (SURS), are set to receive a refund. Refunds will be based on health insurance premiums paid from members’ pensions from July 1, 2013 through September 1, 2014. The premium refunds must be sent to members by June 14, 2015.

If you are affected, you should have received this State issued written notice informing you of options regarding the premium refund. The following is a summary of those options:

- Do Nothing Members who do nothing will receive their full premium refund (and possibly interest) less their proportionate share of legal fees for the class action lawsuit, Kanerva v. Weems, whose settlement resulted in the premium refund.

- Request to Opt-Out Members may notarize and submit an Opt-Out Notice. Members who opt-out would NOT be eligible to receive a refund of premiums as part of the class action settlement, their premium payments would be placed back in the Health Insurance Revolving Fund, and the member would be responsible for the legal expenses of any separate legal action. The Opt-Out Notice must be submitted by March 11, 2015.

- Members who do NOT opt-out, may object to the Legal Fees Members may send a written objection to the legal fees that are deducted from their pension refund. Members who object to the legal fees can be heard by the Sangamon County Court on April 1, 2015. Any objection must be submitted by March 11, 2015.

The amount of legal fees to be subtracted from members’ refunds remains undetermined. The State Universities Annuitants’ Association’s (SUAA) attorneys and others are pushing to base the legal fees on the number of attorney hours worked and a reasonable hourly rate, rather than on a flat percentage of the total settlement.

The Sangamon County Court ordered that the SUAA establish a website to provide information about the health insurance premium refund. The website contains a number of court orders and documents related to Kanerva v. Weems. You can access this website here.

Other Pension Updates At this time, implementation of the pension reform bill passed in 2013 is still pending the outcome of legal challenges to its constitutionality. Oral arguments are expected to begin in March 2015. In his recent budget address, Governor Bruce Rauner proposed new reforms as part of his effort to close the State’s budget gap. At this point, proposals are very preliminary. We believe any legislative action on such proposals is unlikely until a ruling by the Illinois’ Supreme Court on the legislation passed in 2013.

#GivingTuesday

There is no doubt that the holiday season is officially upon us. It is difficult to go out and about and not be inundated with signs for holiday shopping deals. Around every corner is another flashy ad encouraging you to be a good consumer and spend spend spend. That said, there is nothing wrong with holiday shopping and gift giving, but what about giving back in a different way? We have all heard about Black Friday, Small Business Saturday and Cyber Monday, but how many of us are familiar with Giving Tuesday? Giving Tuesday is a nationwide initiative that encourages individuals and organizations to spend the Tuesday after Thanksgiving practicing generosity. So, after you have filled up with food on Thanksgiving, loaded your shopping cart on Black Friday and clicked your way to consumer bliss on Cyber Monday, why not spend Tuesday, December 2nd celebrating generosity by donating to your favorite charities? There are many reasons why people give: altruism, gratitude, recognition, compassion, generosity, the list goes on and so do the benefits. However, one benefit we can all appreciate is the ever famous tax deduction. Recently, Jake Kuebler appeared on WCIA’s Current to discuss charitable deductions and budgeting for charitable giving. For some of Jake’s tips on giving be sure to check out the full segment below.

Bluestem would like to wish you all a very Happy Holiday season!

Kuebler shares insights with Investor's Business Daily

Recently, our own Jake Kuebler spoke with Investor's Business Daily's (IBD) Aparna Narayanan about ways young Advisors are adapting traditional business models by using new technology and social media. Jake’s experience as a young business owner, as well as his leadership on NAPFA Genesis, has given him ample insights into the changing landscape of financial planning. The article hits on several of these new ideas, which you can click here to read.

Kuebler Appears on WCIA's Current to Discuss Couples and Finances

This week, Bluestem’s own Jake Kuebler appeared on the WCIA 3 News program Current, where he sat down with Cynthia Bruno to discuss ways couples can successfully manage their finances. Jake provided tips to help couples be more transparent when it comes to money and their long term financial goals. Jake shared advice on several financial issues including: buying a first home, preparing for children, saving for college and cohabitating vs. marriage. Jake’s biggest advice for couples is to be intentional with their finances. He suggests that planning ahead and making solid decisions early on reduces the need for rushed decisions or limited opportunities in the future. Jake also shared his thoughts on savings, saying that couples should automatically save first and use what is left over for “fun money”. This approach helps couples achieve their goals and worry less about budgeting. We all know that financial issues can be a source of stress for couples, hopefully Jake’s optimism and helpful tips can be a positive influence on your own relationship.

You can watch the full segment below or visit the Current webpage at illinoishomepage.net.

Bluestem Featured in Wall Street Journal

Bluestem was recently featured in the Wall Street Journal. The article focuses on on the challenges of passing ownership to the next generation in succession planning. Specifically, it tells the story of the founding of Bluestem and the partnership between our Advisors, Karen Folk and Jake Kuebler. You can learn more about Bluestem's history on our website on the Our Team Page.

You can read the full article on the Wall Street Journal's Website through this link. Alternatively, you can follow this link for a PDF Copy: WSJ Article; Young Practice Owners Earn Trust Over Time

Kuebler Appears on NewsChannel 15

This past week, NPR's Planet Money released an online tool comparing median income of various cities in relation to how far that income would go. Based on surveys by the Bureau of Economic Analysis, this tool draws on Regional Price Parity; measuring the variation in cost a basket of consumer goods would have in different locations. Especially of interest, the tool indicated residents of nearby Danville, IL see the biggest jump in "perceived" income due to the low cost of living in that area. ABC NewsChannel 15's Kim Shine sat down with our own Jacob Kuebler to discuss. You can see the full news story below.

You may also wish to see the full NPR story by following this link or the original NewsChannel 15 Story by following this link.

Jake Guest Stars on National Radio Show

This past week, Bluestem's own Jacob Kuebler guest starred on Your Money. Nationally broadcast on SiriusXM's Business Radio Channel, this weekly show discusses topics of interest and answers caller's questions regarding their personal finances. The show is hosted by Professor Kent Smetters of the Wharton Business School at the University of Pennsylvania. On the show, Jake got the opportunity to introduce Bluestem to the listening audience and assist callers in answering their questions related to an underwater rental property, prioritizing debt payoff versus savings, and more.

You can listen to the show On Demand by following this link. Show date 5/6/2014. You must either subscribe to SiriusXM or sign up for a trial. Program will be available online until June 9th, 2014.

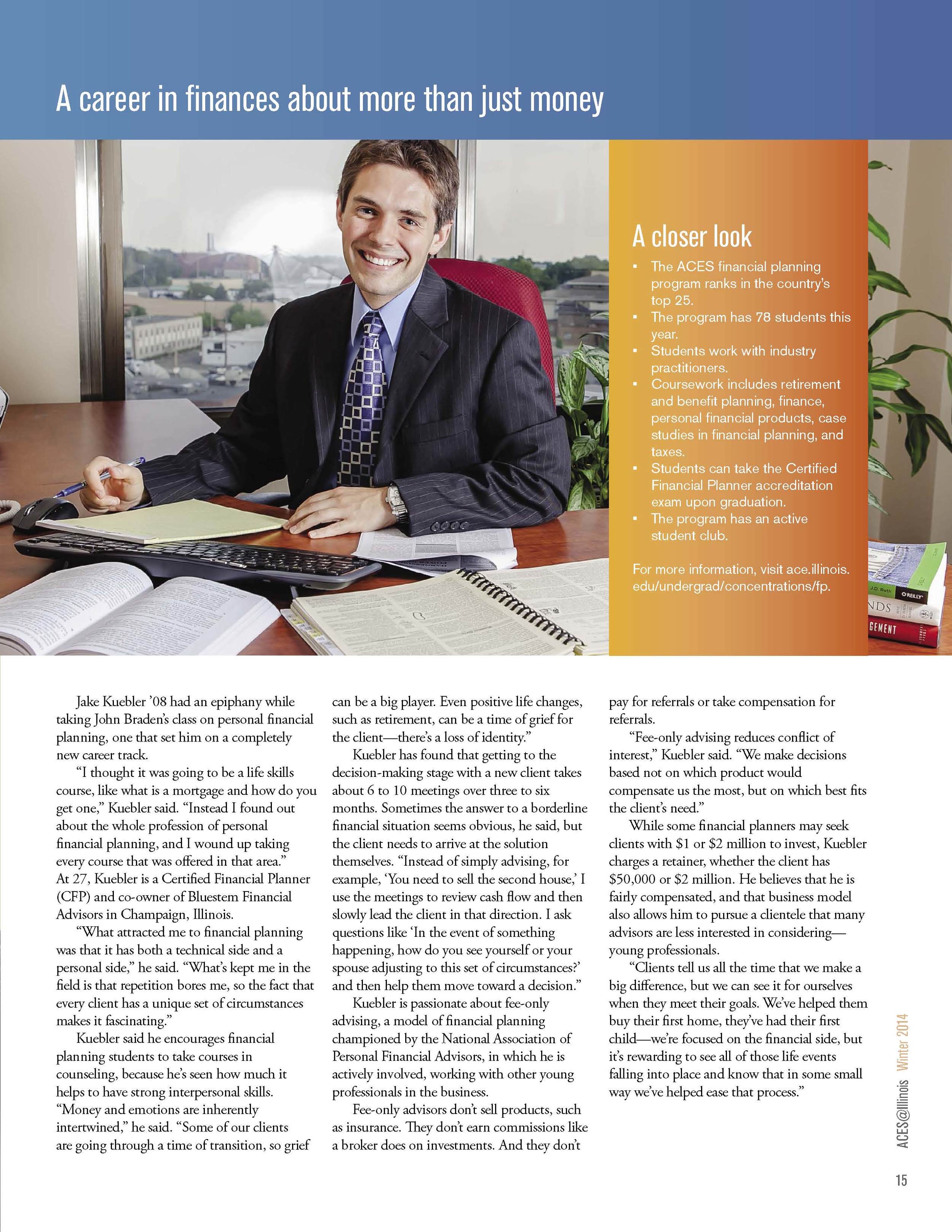

Jake featured in Alumni Magazine

Advisor Jacob Kuebler was recently featured in the 2014 Winter ACES Alumni Newsletter. The article, A career in finances about more than just money, highlights Jake's passion for fee-only financial planning and the benefits that come along with it. See the full article below or click the image to see the full magazine.

Planning for Rising University Tuition

This past week, the University of Illinois Trustees approved a tuition increase. News outlets immediately began reporting that the 4 year expected cost of attending the university now tops $100,000. How can parents plan for this? I was recently interviewed by Adam Rife of WICD News Channel 15 regarding how parents can plan for these changes. I offer a few points to keep in mind regarding this change. This recent announcement of $100,000 expected cost is as much a psychological barrier as an actual one. Similar to your car rolling from 99,999 miles to 100,000, the perception changes much more than the actual mechanics. However, rising costs are a troubling trend for parents planning for college education. For many years, college costs have been rising at about double the rate of increases in the cost of living.

In order to plan for the rising cost of higher education, my best advice as I told Adam is:

I think the key is always starting early, and unfortunately, starting early for most parents means you have a young child and there are a lot of other expenses coming up.

There are two important factors in saving for the future: Time and Dollars Saved. The more you have of one factor, the less you need of the other. Start early and you can save less and end up with more.

You should also keep in mind that the "Sticker Price" of college may not actually reflect the actual cost of attending college. Matching your student's skills and interests with a university or college can help them qualify for higher amounts of financial aid, scholarships and grants. In some cases, a smaller college with higher tuition may offer a more generous aid package to a desirable student than a larger public institution. We have found that College Navigator is one excellent resource for researching schools.

You can check out the full story here:

WICD NewsChannel 15 :: News - Top Stories - 4 Years Of UI Tuition To Top $100,000 For 1st Time.

Further Clarification on Illinois Pension Reform

Updated information on this subject can be found in our latest blog post. This post follows up my initial posting about Illinois Pension reform and specifically how it impacts State University Retirement System (SURS) members. You can read my original post here.

Notwithstanding the likely legal challenges of pension reform, many items are subject to interpretation in the new law. It is likely additional legislative guidance will be needed to fully understand the impact of these reforms. This post is based on information from a knowledgeable representative of SURS, but may change in the future.

Pensionable Earnings Limits

See the original post for complete details on this change. A question that arose is, if your income currently exceeds the limit, how would your future contributions be affected?

SURS interpretation is that your contributions will be based on pensionable earnings. Similar those who contribute to social security, no SURS contributions will be required on salary exceeding the limit. If your salary is grandfathered in, contributions are up to your grandfathered salary. No future pay increases exceeding the limit will increase your grandfathered limit or contributions.

For example, your salary in 2013 is $150,000. The pensionable earnings limit is $110,631.26. You receive a pay increase to $160,000. Your pensionable limit remains at $150,000 and contributions are based on salary up to that limit.

Future raises will not increase your grandfathered limit, which is equal to the participant’s annualized rate of earnings as of June 1, 2014.

Money Purchase Changes

This was not mentioned in my last posting, but changes are also being made to the Money Purchase Formula, which is one of three options for calculating your defined benefit pension. The annuity under this method is calculated by a cash value (determined from contributions made by the employee, employer, plus an effective interest rate determined annually). If used, this system determines the annuity from cash value using an actuarial table. The larger the cash value, the larger the annuity (up to limits). The effective interest rate of that cash value going forward will be the 30-year US Treasury bond rate plus 75 basis points (0.75%). Estimating the current 30-year US Treasury bond rate at 3.85%, the current Effective Interest Rate would be equal to 4.6%. Compare this to the effective interest rate 7/1/12 through 6/30/13 of 7.5%. As the interest rate is decreased, the potential cash value will grow more slowly therefore slowing the potential growth of the annuity.

This will also affect purchasing of service credit and the refund for those in the Portable system.

You should also note, the actuarial assumptions used in determining the annuity tables may now be revised annually. If experienced lifespans are increased or earnings are decreased, annuities calculated under this system would also decrease.