Background:

Disability benefits provided through the State Universities Retirement System (SURS) can be a crucial source of financial support for eligible employees who are unable to work due to an illness or disability. Often overlooked in favor of life insurance, disability insurance is an important consideration for anyone who relies on their income to support themselves and their family, especially for parents with young children.

Without disability insurance, an unexpected injury or illness can quickly lead to financial strain, especially if the individual is unable to work for an extended period. Disability insurance provides a safety net in such situations, offering income replacement and financial support during a difficult time. While disability benefits provided through SURS offer a valuable benefit, they are limited. There is a limited window from February 20 to March 10, 2023 to enroll in a supplemental plan.

Summary of SURS Provided Benefits

As a SURS participant, a portion of your contributions into SURS go towards funding a disability benefit. This benefit is available for those with two years of service credit (except in cases of disabilities caused by an accident). While this benefit is included at no extra cost, it does have some limitations:

· The benefit is limited to 50% of your pay (either base pay or 50% of average earnings over prior 24-months)

· The maximum benefits cannot exceed 50% of your total earnings while a participant in SURS.

Benefits of a Supplemental Policy

Taking these limitations into account, SURS participants are eligible to purchase a supplemental plan through Prudential. This plan is specifically designed to work in tandem with the SURS benefit, filling in gaps in coverage. Some of the specific benefits of this coverage include:

· Increasingthe monthly benefit up to 66 2/3% of your monthly earnings (up to $12,000/month)

· Continuation of benefits, if needed, until Full Retirement Age

· Eligibility for benefits without two years of service.

Case Study

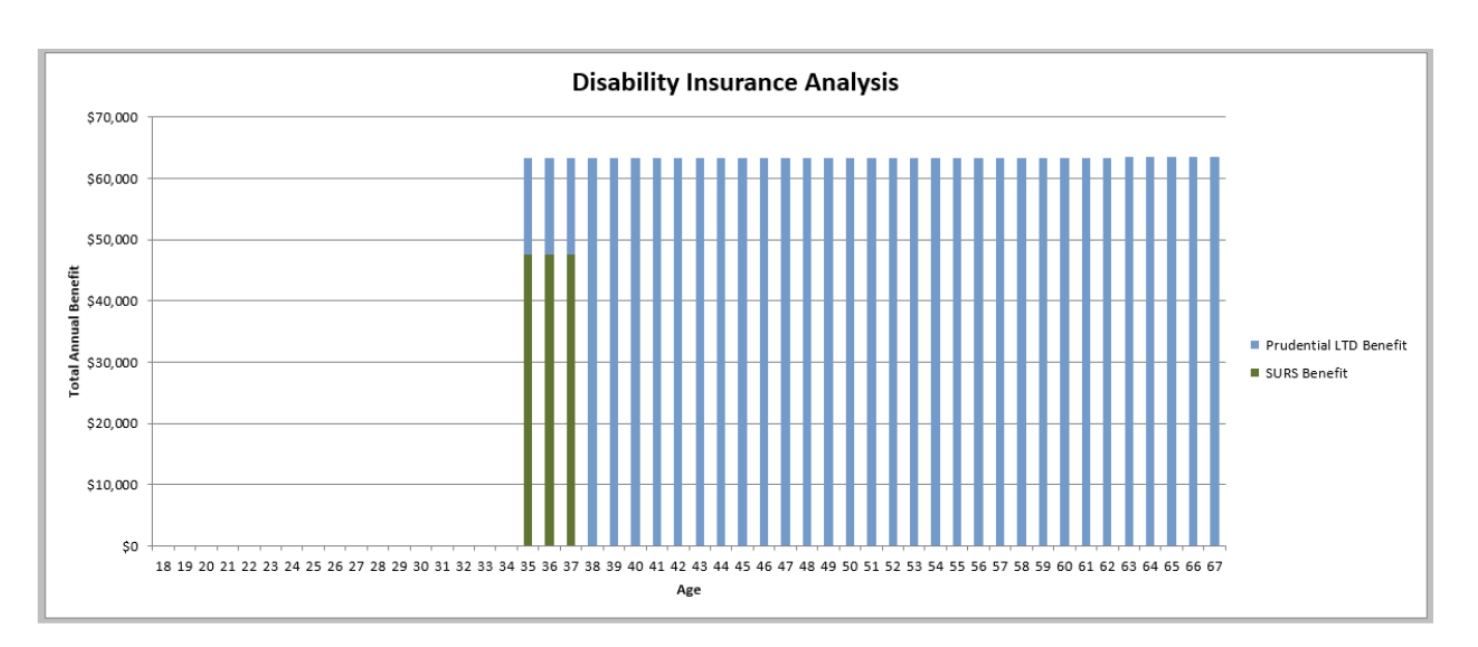

To highlight the importance of this coverage, let’s consider an example. Dr. Sarah Lee, age 35, is an Associate Professor of Sociology earning $95,000 per year. After her third year of employment, Dr. Lee suffers a medical condition that leaves her permanently unable to work and quickly uses up her sick leave.

Under SURS, Dr. Lee is eligible to receive 50% of her monthly income after satisfying the waiting period. This amounts to just under $4,000 per month in benefits. However, as she had only been a participant in SURS for three years, her benefit payout is limited to 50% of her total earnings while in SURS. Her SURS benefits end after about 36 months.

If Dr. Lee opted into the supplemental policy, her benefits increase from around $4,000 per month to $5,300. In addition, her disability benefits will continue until her Normal Retirement Age of 67. This provides nearly 30 years of additional protection as compared to the base SURS benefits!

Special Enrollment

New employees can opt into this Supplemental Disability benefit within 60 days of active employment without medical underwriting. You may enroll later, but could be denied coverage due to pre-existing health conditions.

If you are outside this window and interested in coverage, a limited time opportunity to enroll is being offered. This special open enrollment period for employees is being offered from February 20th – March 10th, 2023. If interested, read more about benefits and how to enroll at http://go.uillinois.edu/enrollltd

Closing Thoughts

Disability insurance is often overlooked and, in many cases, more important than life insurance. This is something that we stress with our clients when reviewing their risks and insurance needs. If you want to learn more about the benefits of having a financial planner, click here to contact us today!