Unpacking tidbits of the tax law passed in the waning hours of 2022

You may recall 2019’s smash hit titled: “SECURE ACT” authored by everyone’s favorite band, Congress. With an eagle-eyed focus on reforming retirement tax law, the SECURE ACT brought a symphony of changes that impacted several of our clients.

But how did the sequel stack up? If the original SECURE ACT was a rock solid album, the SECURE ACT 2.0 is a discography—with more than three times as many provisions as its predecessor. Don’t fret though, we have highlighted some of the more relevant changes for our clients:

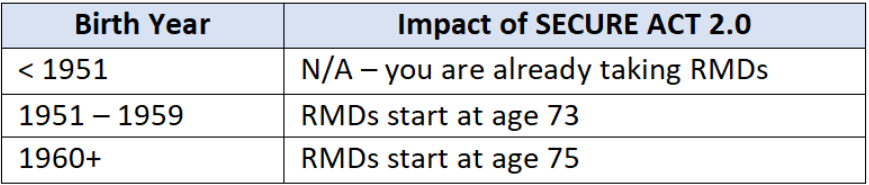

Changes to starting ages for Required Minimum Distributions (RMDs):

Note: A strange occurrence, nobody will “start” RMDs in 2023 or 2033!

Employer contributions to 401(k), 403(b), and similar plans are now eligible for Roth treatment: Previously only pre-tax treatment was available. Such contributions are taxable to the employee as income. It may take some time for plan sponsors to adapt to the change, delaying the availability for employees to elect this option.

“Rothification” of age-related “catch-up” contributions: For a person earning > $145,000 in wages and making “catch-up” contributions into an employer plan, such “catch-up” contributions will be required to be put into Roth portions of the employer plan, increasing taxable income. The good news is that this rule does not take effect until 2024.

Increased “catch-up” contribution limits for those turning 60, 61, 62 or 63 in any year after 2024.

Transfers of 529 Balances into Roth IRAs: There are too many rules and limitations in place to detail here, but this grants an additional avenue for addressing leftover college savings in 529 plans.

Sometimes, a work of art can also be defined by what is not included. Here are a handful of changes that had been discussed as potentially being included in the new law, but did not make the final cut:

Limiting the use of the so-called “Back-Door” or “Mega-Backdoor” Roth contributions.

Changes to the minimum age for Qualified Charitable Distributions (QCD) from IRAs

Clarification on certain IRA Beneficiaries needing to take Required Minimum Distributions (RMD) during their 10-year payout window.

Should any of these changes sound like music to our ears? As always – it depends. Throughout the next year, we will address how SECURE ACT 2.0 affects our clients’ tax picture and overall plan, and whether any adjustments are warranted. In the meantime, please do not hesitate to reach out to your Advisor with any questions!

For Further Reading:

Charles Schwab - SECURE 2.0: How Does it Affect Retirement Plans?

Michael Kitces, et al - SECURE Act 2.0: Detailed breakdown of Key Tax Opportunities