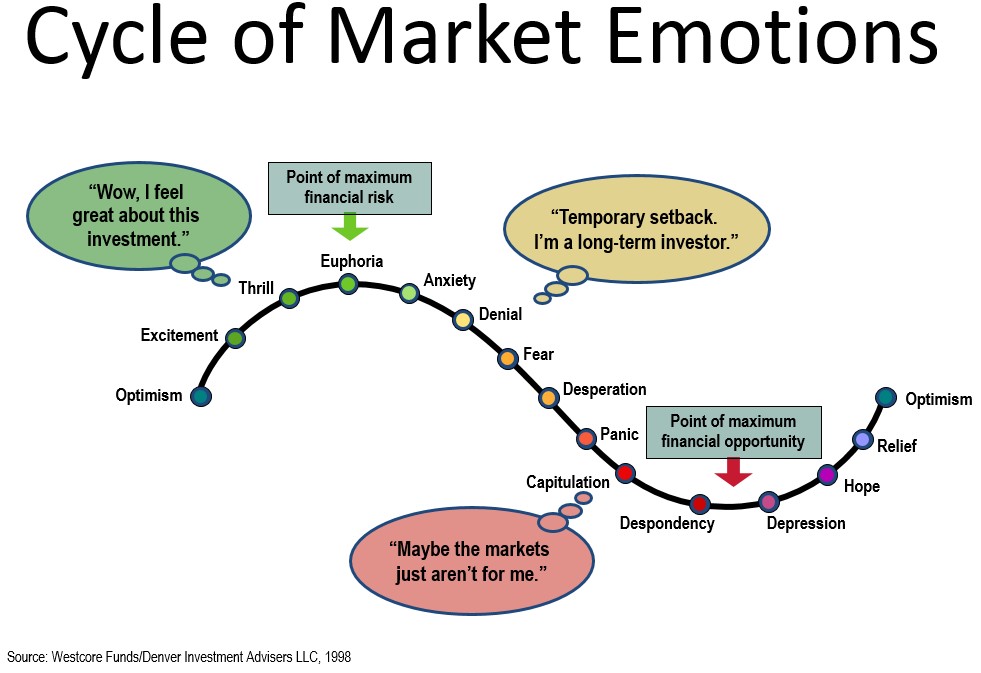

You are probably aware of the stock market activity over the past week. Friday saw the largest drop of the week, rounding out weekly losses in the 5-6% range. This, in turn, fueled massive negative media coverage over the weekend. No doubt, the negative news adds to fears and is one of many factors leading to further losses in the market. As usual, we encourage you to hold steady through the current market gyrations. One soundbite repeated over the weekend news cycle is that the market has not seen a single day drop like Friday’s since 2011. Do you remember which day it was? My guess is that, unless the last drop significantly affected your life or financial plans, the answer is no. The uncertainty of the future can be scary. Our natural first reaction is fear and trying to avoid further losses. Our brains are hardwired to react this way. However, acting on this emotion would be a mistake. It would lead to selling when the market is low, when in reality, that is the complete opposite of the approach you should be taking. The chart below illustrates this.

I predict one of two possible outcomes of the market in the next year:

1. The market will continue to decline as the world economy sorts through its current concerns. For our retiree clients, they will ride the downturn relying on the safety of their bond ladders without fear of where their next paycheck is coming from. For our working clients, they will keep working, contributing regularly into the market and buying stocks while they are on fire sale. Over the long term, the market will recover!

2. The market will recover in the next few weeks and we will quickly forget about the conditions of the past week.

Cycles such as the one we are currently experiencing are part of investing. Doing nothing when the market is getting a little haywire may seem counterintuitive or that we are avoiding the problem. The reality is that sticking to a long term plan through market changes takes resolve and commitment to the stated investment goals. Fighting instinct is hard, but doing so leads to better investment performance in the long run and, more importantly, a better chance of realizing your financial goals.