(And why you should rethink the excuses)

Are you thinking about hiring a Financial Planner, but failing to take action? We see many people who put off the decision for far too long, costing them time or money. Here are some common reasons many fail to hire an advisor and misinformation that you may have heard about financial advisors.

#1 – I do not have enough money

I will concede that Financial Planners have a reputation for only serving the wealthy. Many firms have portfolio minimums, often in the mid-six-figures or more. However, Financial Planning as a profession (not sales as discussed below) is relatively young and still evolving. Early models of the 1980’s and 90’s were built around investment management. Financial planning was a manual, time intensive process. Large portfolios were needed to cover the high cost of doing comprehensive financial planning.

However, this is rapidly changing. Financial Planners, like all entrepreneurs, are continuously developing new business models to serve a wider base of clients. New efficient technology has pushed down the cost of providing services. There are many groups of advisors and companies who provide financial planning services to a wider audience. For instance, online companies such as LearnVest are springing up to provide basic planning services at ultra-low cost. For more customized services, there are advisors who provide hourly consultations, such as those in the Garrett Planning Network. Finally, there are advisors that provide ongoing, holistic services to the middle market, members of the Alliance of Comprehensive Planners.

My point here is, there are many types of advisors out there. You have to be willing to put a little time into your search to find the right fit. The right advisor will provide services in line with your needs, have expertise in issues you face, and communicate with you in a manner that you understand and trust.

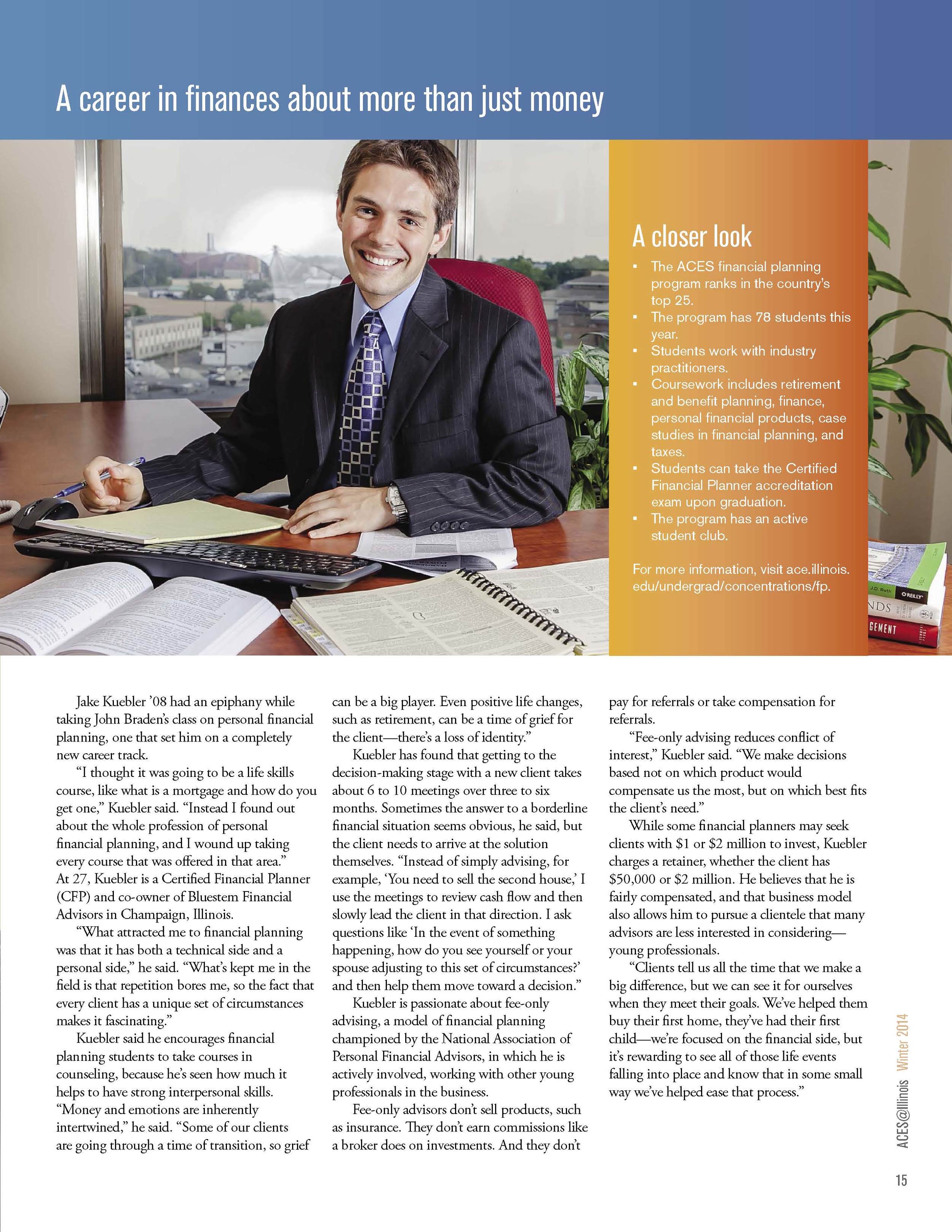

At Bluestem, we not have a minimum portfolio size for new clients. We are a growing firm and always accepting new clients, but we do limit our growth each year to ensure that we provide the best service we can to new and existing clients. This means we are selective about the clients we take on in order to ensure that our expertise and services match their needs.

#2 – Financial Planning means “Sales”

I sometimes get uncomfortable when people ask me what I do for a living. Not because I am ashamed, but because of the response I get to saying Financial Planner. There is is a lot of negative connotation behind the title.

The problem lies in the lack of regulation or consistency of the title Financial Planner/Advisor. Pretty much anyone can use the title, regardless if they are actually providing planning services or are just a salesperson for investments or insurance products. There have been efforts to clarify, but the sales industry is quick to mimic true financial advisors or confuse consumers. Even so, those selling products cannot copy what a true Financial Planner really does, so let me tell about that.

A true financial planner is interested in who you are. They want to learn your goals, ambitions and values. They understand that maximizing your income and wealth are important, but only because that helps you achieve something more. Money is not the end result. Once they understand who you are and what you are about, they help you begin piecing together a financial strategy to achieve those goals and values.

They understand there are many pieces to your financial life to manage; human capital (career), taxes, insurance, children, legal, retirement, and the list goes on. A planner is there to help you make decisions that encompass all the different areas.

I have been called a Jack of all Trades and Master of None. In the context, it was meant to be negative, but it has some truth. My knowledge is broad by design. I need personal skills to learn about you and technical skills to see how all the pieces fit together. I also have to recognize how changing one financial piece of your life will affect another. I am a professional and recognize my limitations. When depth of knowledge is needed, I maintain an arsenal of professionals to assist. Attorneys, Insurance Agents, CPAs, Real Estate Agents, and Brokers may be brought in when needed. Alone they may not know the whole picture, but I am there to assure that a cohesive result is achieved for my clients.

If you are looking to hire an advisor, be willing to ask lots of questions. You should be especially interested in hearing about the process of working with the advisor. Results are important, but there are no guarantees in life. There are too many unknown variables for a professional to make promises they cannot keep. Do not be influenced by flashy marketing with anecdotal success stories and past performance statistics. That may not indicate success for your future. Focus on hiring someone who has a solid process to help you evaluate your needs, anticipate changes and help you adjust course as needed.

#3 – I can do it myself

I concede, this one is actually true. You probably can do it yourself. Be honest with yourself, will you? Will you devote the time to set goals, educate yourself, evaluate important financial decisions, monitor your progress and adjust as needed? Most of us will not. It is too easy to get caught up in day-to-day life to think about our own future objectively or strategically.

Would it surprise you to know I hired my own Financial Advisor? It is not because I cannot do it myself. It is because I know there is value in having an objective third party. Someone who can cut through my own emotional and mental roadblocks. Someone who can force me to take a long term view and someone who can coach and encourage me to keep moving in the right direction.

There are many reasons someone might hire an advisor. Some people like to manage their own plan, but hire an advisor for an objective review to validate that they are on the right track. Others find they have little patience for the process and do not enjoy learning the ins and outs of financial planning. They hire an advisor to delegate and turn over the responsibility to a competent planner.

#4 – I cannot afford to hire an Advisor

Many of us are willing to make an investment if we expect the future benefits will be greater than the initial outlay. The same should be true of hiring an advisor. I believe any advisor you hire should, in the long term, add more value than the cost of their services

As clichéd as it may sound, sometimes peace of mind can be one of the biggest values in hiring an advisor. Research from the Consumer Federation of America (CFA) and Certified Financial Planner Board of Standards (CFP Board) has shown that families that take time to plan have better financial preparedness for meeting goals and dealing with emergencies, save more and are more confident about their finances. Is it worth your money to sleep better at night, avoid arguments with a spouse over money, or to know you are on the right track?

Maybe you are skeptical and want to see hard dollar savings. Morningstar, an investment research firm, has attempted to quantify the value of hiring an advisor. They define gamma as value an advisor adds to an individual through the financial planning process. These values include added investment returns through optimizing portfolio allocation, withdrawal strategies and tax savings. They postulate the added return could be as high as 1.59% of your portfolio.

This research does not even include the savings of avoiding mistakes such as incorrect tax returns, buying the wrong financial product, paying unnecessary fees to high cost institutions and financial products. How about the cost of inaction? How much are you paying because you fail to take action?

#5 – This is not the right time OR I do not have the time

I hear this a lot. Someone will reach out because they are experiencing a life transition that comes with a financial pain or have an important decision to make. The person is so caught up in the life transition, they ignore or procrastinate making needed financial decisions. They deal with the symptoms, not the underlying problem.

I think a person’s overall health and well-being is like a wagon wheel. Each spoke represents one aspect of the person’s life. The spokes include physical, mental, relationship, spiritual/moral/religious, and financial health. In order for the wheel to be round and turn easily, you need to devote equal time and energy to all. Otherwise, your wheel may become flat in certain sections and have trouble moving you forward.

Another way to put it, if you ignore one area of overall health and balance, you may end up harming the whole system. Taking the time to make a plan will take an investment of time and energy, but will pay off with future peace of mind, flexibility and independence.