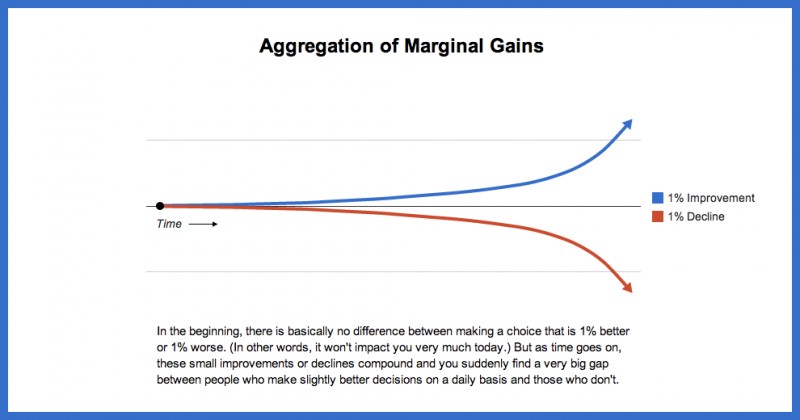

Financial Planning is often thought of as a quantitative field. Planning is done to answer questions such as how much should I be saving, how should I invest or how can I reduce my tax liability. Numbers are collected, plugged into a formula and out comes a result. When questions are answered individually, solutions can be maximized to seek the best result. For example, maximizing portfolio returns might be done by gathering facts about time horizon (period of time funds will be invested), risk tolerance (how much risk you are willing to take), and investment choices (what choices are available in your investment plan). The problem with maximizing is you are often constrained to looking at a single piece of a larger financial picture. Are your choices about investing impacting your tax situation? Are immediate financial goals competing with longer term goals? Taking a comprehensive approach to planning can help here by taking time to understand the bigger financial picture. Where are the trade offs between decisions? How will one decision affect another? How do you balance a series of choices that all impact each other?

This is how I would define Comprehensive Financial Planning. Working with an advisor knowledgeable in multiple areas of finances; taxes, insurance, investing, retirement, and so on. The advisor working with you to create a plan considering how each area will impact the other. Comprehensive Planning can achieve good results, but can it achieve the Optimal Results?

Sometimes planning hits a wall where the best recommendation conflicts with what you are willing to change. The best answer is not always the most acceptable answer. To reach a goal under current circumstances, perhaps the best answer is to work longer, work more, spend less, delay satisfaction and save more. In reality, finances are really just a tool used to achieve life goals. Sometimes, it is better to adjust the goal than to adjust the financial situation.

The following is an illustration we often use with clients. It shows many values one might hold in their life. In each area, we ask them to rank how satisfied they are, by placing a dot to represent the level. The innermost circle represents low satisfaction and the outermost represents complete satisfaction. The ultimate goal is to balance each area out so that when you connect the dots, they form a truer circle.

In Example 1, the person is very out of balance. A lot of time and energy might be focused on career, giving a lot of satisfaction in that area plus leading to financial security, but leaving insufficient time for family and social activities. In the planning realm, decisions might need to be made to correct this imbalance. With this illustration, it might become clear that some financial goals can be sacrificed in exchange for other life goals. To reach Example 2, it would be more acceptable to cut work hours, save less, but have more time to devote in the areas of social and family activities.

It is not uncommon for our clients to begin to see these trade offs. When you reach financial independence, choices becomes less about accumulating more. Instead, focus shifts to using money to do things like buy time (outsourcing housekeeping or yard work to free up time to be spent with family). Or, maybe the career becomes less important as salary or advancement opportunities are forgone in exchange for time to focus on social endeavors.

To me, this is the process of Optimizing a financial plan. Taking the time to step back and see the big life picture. Not only making the right financial choice, but making the best use of financial resources to achieve all of life’s goals. If you are ready to optimize your life, contact us today.

Action 2: Request credit reports from at least one of the three Credit Reporting Agencies. Review your report for any lines of credit that you don’t recognize. The report will have instructions on disputing your account if needed. Reports may be accessed for free at

Action 2: Request credit reports from at least one of the three Credit Reporting Agencies. Review your report for any lines of credit that you don’t recognize. The report will have instructions on disputing your account if needed. Reports may be accessed for free at

Paper versus Electronic account statements:

Paper versus Electronic account statements: