The New Year is a good time to make sure your retirement contributions are on track to be maximized for the upcoming year. These thresholds are higher for 2024 than they were for 2023, so if you were already maximizing them in 2023, an adjustment may be necessary.

Tip of the Month: Safeguarding Your Digital Legacy

Annuities for Academics: TIAA Traditional Demystified

Cybersecurity Tip of the Month: Watch Out for Phone Spoofing and AI Scams

Tip of the Month: How to Make the Most of Your Spending

Tip of the Month: Preventing Check Washing

Disability Insurance: Covering the Underestimated Scenario

Regardless of your employer, remember that it is all too common to underestimate the possibility of an extended illness or other event that would make full-time employment impossible. Take a closer look at the disability benefits offered through your employer and consider if additional long-term disability insurance would protect the financial health of your family.

Finances and Fertility: Exploring Options to Help Grow Your Family

Tip of the Month: Sign Up for a Password Manager

What are password managers?

There are a few different sites to choose from, but in general a password manager keeps all your passwords in a “vault” which is accessible with a single sign-in. It adds a layer of security by generating secure passwords and keeping them safe and secure in a singular location. You can also add layers of security using two-factor authentication! These sites are wonderfully useful in taking the hassle out of creating and keeping track of all your important passwords.

What are the options?

LastPass

Bitwarden

1Password

NordPass

How does it work?

By creating an account you can organize all your passwords in a single location

You use a “master password” to log in and then the manager can autofill your other passwords directly on your phone or computer.

You can create folders to categorize and keep track of all passwords in one secure location

The “generate password” feature can be used any time you need a new, secure password and it will save that information into your vault

Ways to make the most of password managers:

Shared folders: depending on the subscription you’re able to share your vault folders with another trusted contact or family member, which is great for kids or parents who share login information

Keep your master password somewhere secure, perhaps in your physical files, or written into your estate documents in case someone needs to access your information in an emergency

Autofill feature is very useful for saving time when logging into different sites

Want more information?

We use LastPass at our office, but any one of the services listed above has plenty of resources and guides that can teach you how to make the most of your password manager! If you have any questions or would like to know more please reach out to our office via phone or email.

SURS Pension: A Good Start, but is it Enough?

How To: Add a Shortcut on Your Smart Phone to Access the Bluestem Portal

Finding Your Philanthropic Focus - Guest Blog Post

Finding Your Philanthropic Focus

By Shari Fox, CAP®

Principal, Fox Philanthropic Advisors LLC

Are you interested in using more of your financial resources to help others? Do you want to give more but find it challenging to decide where to donate your time and resources? Do you want to ensure the charitable giving you are already doing has the most significant impact possible? Have you ever felt overwhelmed by the sheer number of charities and causes out there, making it difficult to know where to start?

If you've answered yes to any of these questions, then this blog is for you. We'll explore the steps you can take to narrow your focus in charitable giving, allowing you to make a real difference in the world. Are you ready to learn how to make the most of your charitable donations and help those in need? Let's dive in!

To start, look at the giving you are already doing. You likely compiled receipts from the charitable organizations you supported last year to file your tax return. Or if you have a donor advised fund, maybe you reviewed a summary of your grants for the year. Did you notice anything? Was there a pattern? Did you make a few large gifts to organizations within a particular cause (education, global health, or the environment, for instance)? Or did you make a lot of small to modest gifts all over the place?

First, whichever of the above holds true for you – thank you. Thank you for being generous and caring about your communities, local and global. If those gifts add up to a substantial portion of your income or wealth, though, particularly if the total is large enough for you to itemize deductions, you have an opportunity to be intentional about making a difference.

Think about that for a minute. What change would you like to make in the world? Seriously. What would you like to accomplish with your money that would be meaningful to you?

If you’ve never taken the time to determine your philanthropic focus, start by reflecting on your motivations for giving.

⠀⠀⠀⠀⠀⠀⠀⠀· Why do you give? Is it in response, or is it to create?

⠀⠀⠀⠀⠀⠀⠀⠀· What do you hope to gain from your giving?

⠀⠀⠀⠀⠀⠀⠀⠀· What do you want to sustain in the world?

⠀⠀⠀⠀⠀⠀⠀⠀· What do you want to change in the world?

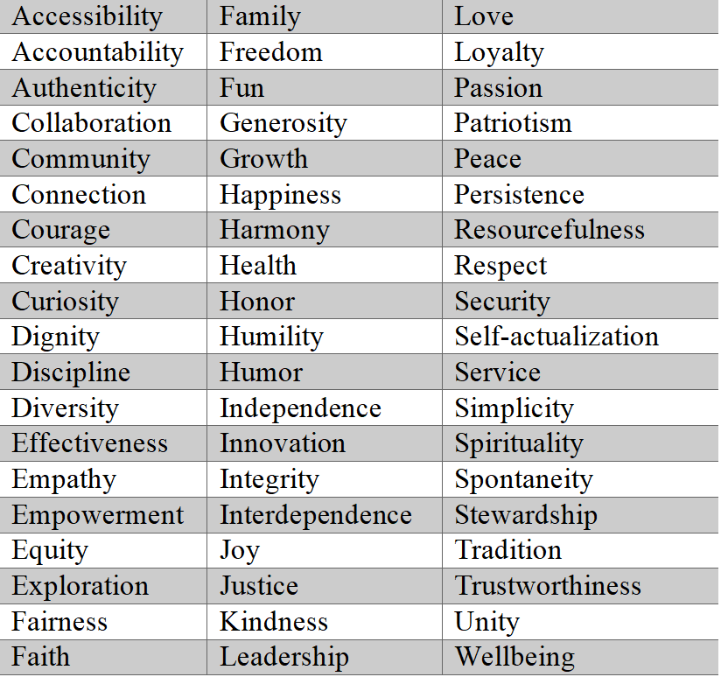

Write down your answers. Then, reflect on your core values. Here are some possibilities.

Try to narrow it to three from this list, five tops. Write them down. Are they reflected in your charitable contributions? Review that stack of receipts from charitable organizations, the one you compiled for your tax return. Is there an opportunity for you to establish a philanthropic plan that more intentionally aligns with your core values?

Identifying your philanthropic focus can make giving less reactionary and more meaningful. It's crucial to uncover your motivations for charitable giving to make sure that your donations have a more significant impact. I had the pleasure of getting to know a woman who did just that. She turned 100 recently, and we sat down to discuss her reflections on a lifetime of philanthropy. She told me that since she was a young adult, she has always been open to giving to community needs. As she became more experienced as a donor and volunteer, though, she realized how much her childhood experiences and her access to a good education, particularly a college degree, had influenced her life as an adult. With that in mind, she began to focus her dollars and her time in the areas of women and education, particularly in her local community. Her primary areas of support include programs that help women advance their education and employment opportunities.

Through her volunteer efforts, she also saw that many children did not have opportunities to interact in productive ways outside of the classroom, and that the only way many of them knew students of other schools was as rivals on the playing field or court. She decided that in addition to programs that help women achieve their personal goals, she would prioritize developmental and social programs that bring together children and teens from different backgrounds, believing that when combined with a good foundational education, these would help them grow into healthy, engaged citizens.

These areas of emphasis would, in this philanthropist’s thinking, improve lives and contribute to the betterment of society as a whole.

Another couple with whom I’ve worked had a particular interest in leadership development, as they had each risen to positions of prominence during their careers. This, too, is a broad category, so they spent time discussing where and how they wanted to have an impact. They landed on supporting student leadership programs at their alma maters, funding leadership development retreats and programs to bring back successful alumni for multi-day residencies. In addition, they funded an academic research project to determine the impact of one university’s student leadership programs on its alumni success, thereby informing the efficacy of their contributions and others’.

These are simply two examples of donors being intentional about their philanthropic focus. There are many others, whether they be healthcare, medical research, animal welfare, the arts, environmental sustainability, mental health – the list is long and the need for investment is great. Like other worthy endeavors, doing philanthropy well takes some work. The rewards, however, can be beyond measure.

This post was guest written by Shari Fox of Fox Philanthropic Advisors. If you would like to delve deeper into your personal or family philanthropic mission and practice, contact me at sharifox@foxphilanthropic.com for an exploratory conversation. The first one is on me.

The team at Bluestem believe that charitable giving can play a crucial role in helping our clients achieve a more fulfilled life. If you're interested in incorporating charitable giving into your tax and financial plan, we would love to help. Here is how to connect and learn more.

Fox Philanthropic Advisors LLC Disclaimer: This information is not intended as legal, tax, or financial planning advice. Readers should consult with their own professional advisors before making any charitable gift.

Save for Later: How to Control Impulse Spending

Navigating Benefit Decisions During the University of Illinois Urbana-Champaign’s Open Enrollment

Shred & Protect: Safeguarding Your Confidential Information

Making Sense of Medicare IRMAA, a Universally Confusing Topic

The forename Irma is of Germanic origins and means “universe.” For many retirees, Medicare IRMAA is of universally confusing origin. In this article we’ll cut through some of the bewilderment, and hopefully leave you with a sounder understanding of IRMAA’s purpose, calculation, and planning opportunities.